See our commentary, with Michael Mandel, in today’s Wall Street Journal: Robots Will Save the Economy.

Ajit Pai’s Welcome Return to Internet Innovation

FCC Chairman Ajit Pai gives speech announcing new approach to Internet regulation, in Washington, D.C., April 26, 2017.

Here’s our latest in Forbes . . . Ajit Pai’s Welcome Return to Internet Innovation:

“Yesterday, Ajit Pai, the new Chairman of the Federal Communications Commission, announced a roll back of the Obama administration’s aggressive regulatory approach to the Internet, adopted in early 2015. This afternoon, Pai will release the text of the proposed rule-making, which will launch several months of public comment.

“In yesterday’s speech, Pai emphasized the Internet’s historic success, based on a bipartisan approach adopted in the Clinton administration, which elevated innovation over regulation by consciously rejecting the old telephone rules for the emerging digital economy:

Under this framework, a free and open Internet flourished. Under this framework, America’s Internet economy produced the world’s most successful online companies: Google, Facebook, and Netflix, just to name a few. Under this framework, the private sector invested about $1.5 trillion to build the networks that gave people high-speed access to the Internet. And under this framework, consumers benefited from unparalleled innovation. But two years ago, the federal government’s approach suddenly changed.

Dawn? Or doom? I vote dawn.

Here is video of a presentation from last October’s Dawn or Doom technology conference at Purdue University, where I previewed the Coming Productivity Boom research.

The Coming Productivity Boom: Transforming the Physical Economy with Information

We’re excited to share this new research, conducted with Michael Mandel, and commissioned by the Technology CEO Council. Here’s the Executive Summary:

We’re excited to share this new research, conducted with Michael Mandel, and commissioned by the Technology CEO Council. Here’s the Executive Summary:

Executive Summary

The Information Age is not over. It has barely begun.

● The diffusion of information technology into the physical industries is poised to revive the economy, create jobs, and boost incomes. Far from nearing its end, the Information Age may give us its most powerful and widespread economic benefits in the years ahead. Aided by improved public policy focused on innovation, we project a significant acceleration of productivity across a wide array of industries, leading to more broad-based economic growth.

● The 10-year productivity drought is almost over. The next waves of the information revolution—where we connect the physical world and infuse it with intelligence—are beginning to emerge. Increased use of mobile technologies, cloud services, artificial intelligence, big data, inexpensive and ubiquitous sensors, computer vision, virtual reality, robotics, 3D additive manufacturing, and a new generation of 5G wireless are on the verge of transforming the traditional physical industries—healthcare, transportation, energy, education, manufacturing, agriculture, retail, and urban travel services.

● At 2.7%, productivity growth in the digital industries over the last 15 years has been strong.

● On the other hand, productivity in the physical industries grew just 0.7% annually, leading to anemic economic growth over the last decade.

● The digital industries, which account for around 25% of U S private-sector employment and 30% of private-sector GDP, make 70% of all private-sector investments in information technology. The physical industries, which are 75% of private-sector employment and 70% of private-sector GDP, make just 30% of the investments in information technology.

● This “information gap” is a key source of recent economic stagnation and the productivity paradox, where many workers seem not to have benefited from apparent rapid technological advances. Three-quarters of the private sector—the physical economy—is operating well below its potential, dragging down growth and capping living standards.

● In particular, the crucial manufacturing sector, outside the computer and electronics industry, has barely boosted its capital stock of IT equipment and software over the past 15 years. Not surprisingly, productivity growth in manufacturing has slowed to a crawl in recent years.

● Information technologies make existing processes more efficient. More importantly, however, creative deployment of IT empowers entirely new business models and processes, new products, services, and platforms. It promotes more competitive differentiation. The digital industries have embraced and benefited from scalable platforms, such as the Web and the smartphone, which sparked additional entrepreneurial explosions of variety and experimentation. The physical industries, by and large, have not. They have deployed comparatively little IT, and where they have done so, it has been focused on efficiency, not innovation and new scalable platforms. That’s about to change.

● Healthcare, energy, and transportation, for example, are evolving into information industries Smartphones and wearable devices will make healthcare delivery and data collection more effective and personal, while computational bioscience and customized molecular medicine will radically improve drug discovery and effectiveness. Artificial intelligence will assist doctors, and robots will increasingly be used for surgery and eldercare. The boom in American shale petroleum is largely an information technology phenomenon, and it’s just the beginning. Autonomous vehicles and smart traffic systems, meanwhile, will radically improve personal, public, and freight transportation in terms of both efficiency and safety, but they also will create new platforms upon which entirely new economic goods can be created.

● Manufacturing may be on the cusp of transformation—not just by robotics and 3D printing, but by the emergence of smart manufacturing more broadly: a fundamental rethinking of the production and design processes that substantially boost productivity and demand. That, in turn, could create a new set of manufacturing-related jobs and allow American factories to compete more effectively against low-wage rivals.

● Far from a jobless future, a more productive physical economy will make American workers more valuable and employable. It also will free up resources to spend on new types of goods and services. Artificial intelligence and robots will not only perform many unpleasant and super-human tasks but also will complement our most human capabilities and make workers more productive than ever. Humans equipped with boundless information, machine intelligence, and robot strength will create many new types of jobs.

● Employment growth in the digital sector has modestly outpaced employment growth in the physical sector, despite the big edge in productivity growth for digital industries. This suggests that we can both achieve higher living standards and create good new jobs. The notion that automation is the key enemy of jobs is wrong. Over the medium and long terms, productivity is good for employment.

● How much could these IT-related investments add to economic growth? Our assessment, based on an analysis of recent history, suggests this transformation could boost annual economic growth by 0.7 percentage points over the next 15 years. That may not sound like much, but it would add $2.7 trillion to annual U.S. economic output by 2031, in 2016 dollars. Wages and salary payments to workers would increase by a cumulative $8.6 trillion over the next 15 years. Federal revenues over the period would grow by a cumulative $3.9 trillion, helping to pay for Social Security and Medicare. State and local revenues would rise by a cumulative $1.9 trillion, all without increasing the tax share of GDP.

● Expanding the information revolution to the physical industries will require an entrepreneurial mindset—in industry and in government—to deploy information technology in new ways and reorganize firms and sectors to exploit the power of IT. Some of these technological transformations are already underway. Public policy, however, will either retard or accelerate the diffusion of information into the physical industries. Better or worse policy will, in significant part, determine the rate at which more people enjoy the miraculous benefits of rapid innovation, both as workers and consumers.

● Better tax policy, for example, can encourage domestic investment and the allocation of capital into more cutting-edge projects and firms. Closing the information gap also will demand the ability of regulators in the physical industries—from the Food and Drug Administration to the Department of Transportation, and every agency in between—to embrace innovation and technological change. Mobilizing information to dramatically improve education and training is imperative if we want our citizens to fully leverage and benefit from these emerging opportunities. Encouraging investment in communications networks, which are the foundation of most of these new capabilities, is also a crucial priority. The free flow of capital, goods, services, and data around the world is as essential as ever to innovation and productivity.

● Launching this new productivity boom thus demands a new, pro-innovation focus of public policy.

Read the entire report.

Samsung seeks another patent victory at Supreme Court vs. Apple

After several decades when patents were handed out like candy, leading to a litigious free-for-all, the courts and Congress over the past few years have begun tightening the reins. This is important if we want intellectual property to promote real technological innovation, rather than frivolous legal entrepreneurship.

Among the signs of progress, the Supreme Court in December 2016 ruled 8-0 for Samsung, reversing a large $300 million award to Apple. In my view, the Court made the right call that the 19th century law governing design patents, which concern the look and feel of products, was being misapplied in a modern smartphone world.

On the heels of its victory, Samsung is now asking the Supreme Court to look at another patent squabble with Apple. This case concerns substantive questions of patent validity and infringement and also an unusual procedural question – both of which could have important implications for IP law.

In this case, Apple initially prevailed 2-1 in its charge that Samsung infringed three patents, which we’ll call:

- a 1996 “quick links” patent with “analyzer server” (‘647);

- a “slide to unlock” patent (‘721); and

- an “autocorrect” patent (‘172)

Upon appeal, however, the Federal Circuit ruled 3-0 for Samsung – finding that patent 1. was not in fact infringed and that patents 2. and 3. are invalid because they are obvious.

Apple requested en banc review by the entire court, but the parties did not hear from the court for six months. Until, suddenly, an en banc order was issued overturning the 3-0 ruling, without any hearing, briefs, or notice. Normally, a court will first announce it has taken a case en banc (or not), and later issue an opinion. In patent cases especially, there is usually further briefing and often a hearing. Court watchers were thus surprised by the unusual procedure (or lack thereof). All three judges from the 3-0 decision dissented with gusto, questioning the en banc review’s substance and procedural irregularities.

Samsung is thus returning to the Supreme Court, petitioning for cert on March 10. Getting the High Court to hear your case is always hard. They only take a small minority of those who ask. And the Court just decided a case with the same two litigants in December. On the other hand, the Court has been keen to reform patent law over the past few years, and its 8-0 decision in December reveals a likeness of mind to further the “patent reformation,” as I’ve called it. The High Court may want to clarify some of these utility patent questions like it did for design patents in the last case, as well as resolve the highly unusual en banc behavior, lest that court make it a habit. The strength of the three dissents by the 3-0 panel also makes it somewhat more likely they’ll take it.

In fact, FOSS Patents argues that

What’s ambitious about Samsung’s petition is that it raises three questions for review, covering the big three patent litigation questions:

· validity (here, obviousness),

· remedies (here, injunctive relief, which is always a more important issue than damages unless damages would really be devastating), and

· infringement (here, whether all elements of the relevant “quick links” claim were infringed).

If the Supreme Court granted all three, it would be the most comprehensive patent case ever before the top U.S. court, and the implications of a decision could, collectively, go beyond Alice.

Thus, if the High Court really wants to extend its recent efforts to improve patent law, this might be the case to do it.

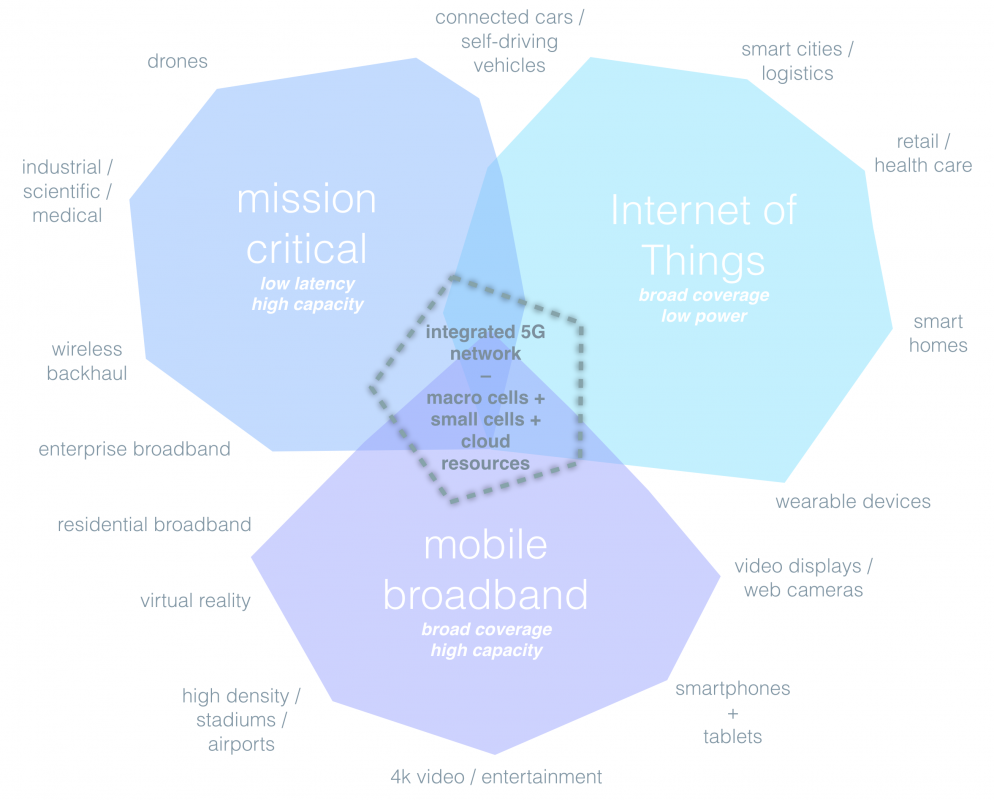

Can Indiana lead in the 5G economy?

“A revival of economic growth in the U.S. and around the world will, to a not insignificant degree, depend on the successful deployment of the next generation of wireless technology.

“A revival of economic growth in the U.S. and around the world will, to a not insignificant degree, depend on the successful deployment of the next generation of wireless technology.

“The Internet’s first few chapters transformed entertainment, news, telephony, and finance — in other words, the existing electronic industries. Going forward, however, the wireless Internet will increasingly reach out to the rest of the economy and transform every industry, from transportation to education to health care.

“To drive and accommodate this cascading wireless boom, we will need wireless connections that are faster, greater in number, and more robust, widespread, diverse, and flexible. We will need a new fifth generation, or 5G, wireless infrastructure. 5G will be the foundation of not just the digital economy but increasingly of the physical economy as well.”

That’s how I began a recent column summarizing my research on the potential for technology to drive economic growth. 5G networks will not only provide an additional residential broadband option. 5G will also be the basis for the Internet of Things (IoT), connected cars and trucks, mobile and personalized digital health care, and next generation educational content and tools. The good news is that Indiana is already poised to lead in 5G. AT&T, for example, has announced that Indianapolis is one of two sites nationwide that will get a major 5G trial. And Verizon is already deploying “small cells” – a key component of 5G networks – across the metro area, including in my hometown of Zionsville (see photo).

Small cell lamppost in Zionsville, Indiana.

If Indiana is to truly lead in 5G, and all the next generation services, however, it will need to take the next step. That means modest legislation that makes it as easy as possible to deploy these networks. Streamlining the permitting process for small cells will not only encourage investment and construction jobs as we string fiber optics and erect small cells. It will also mean Indiana will be among the first to enjoy the fast and ubiquitous connectivity that will be the foundation of nearly every industry going forward. In many ways, 5G is the economic development opportunity of the next decade.

There is legislation currently moving in the Indiana General Assembly that could propel Indiana along its already favorable 5G path. Sponsored by Sen. Brandt Hershman, SB 213 is a common sense and simple way to encourage investment in these networks, and the multitude of services that will follow.

The great news is that 5G is one of the few economic and Internet policy issues that enjoys widespread bipartisan support. The current FCC chairman Ajit Pai supports these streamlining polices, but so did the former Democratic chairman Tom Wheeler:

The nature of 5G technology doesn’t just mean more antenna sites, it also means that without such sites the benefits of 5G may be sharply diminished. In the pre-5G world, fending off sites from the immediate neighborhood didn’t necessarily mean sacrificing the advantages of obtaining service from a distant cell site. With the anticipated 5G architecture, that would appear to be less feasible, perhaps much less feasible.

I have no doubt other states will copy Indiana, once they see what we’ve done – or leap ahead of us, if we don’t embrace this opportunity.

Here are a few of our reports, articles, and podcasts on 5G:

Imagining the 5G Wireless Future: Apps, Devices, Networks, Spectrum – Entropy Economics report, November 2016

5G Wireless Is a Platform for Economic Revival – summary of report in The Hill, November 2016

5G and the Internet of Everything – podcast with TechFreedom, December 2016

Opening the 5G Wireless Frontier – article in Computerworld, July 2016

– Bret Swanson

How the Internet Will Become the ‘Exanet’

See our latest at Forbes: How the Internet Will Become the ‘Exanet’

Today’s Internet has transformed media and delivered prodigious value to consumers, in entertainment, ecommerce, and personal productivity.

Yet the next waves of the Internet will extend to new industries in the physical world, delivering a far greater variety of services and requiring connectivity that is even faster, more ubiquitous, and more robust than today. To drive and accommodate this information embrace by the real economy, we’ll need something bigger and better than the Internet. We’ll need the “exanet.”

In 2016, global Internet traffic likely topped 1,000 exabytes. A thousand exabytes equals one zettabyte (ZB), or a billion trillion (1021) bytes, which is roughly 114 million years of high-definition video. Over the last 20 years, since the dawn of the dot-com era in 1996, monthly Internet traffic has grown around 90 million-fold. continue reading . . .

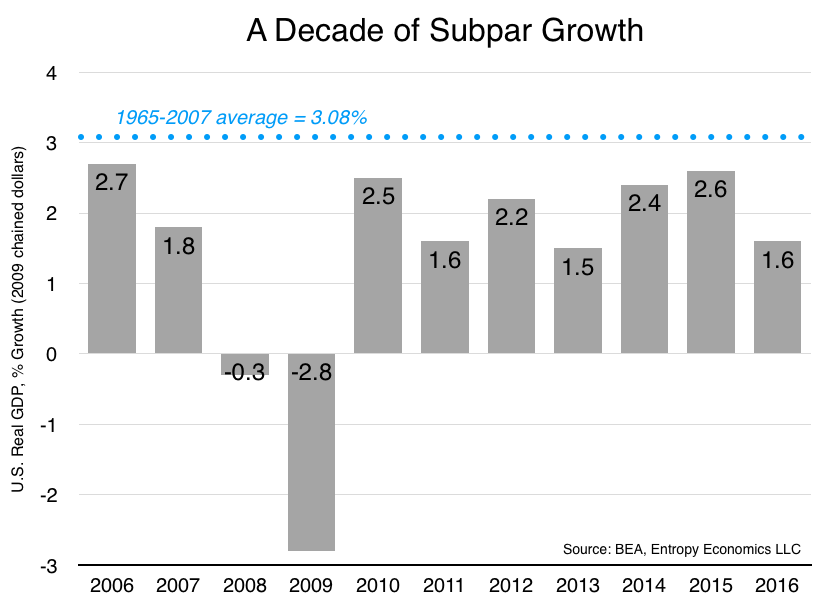

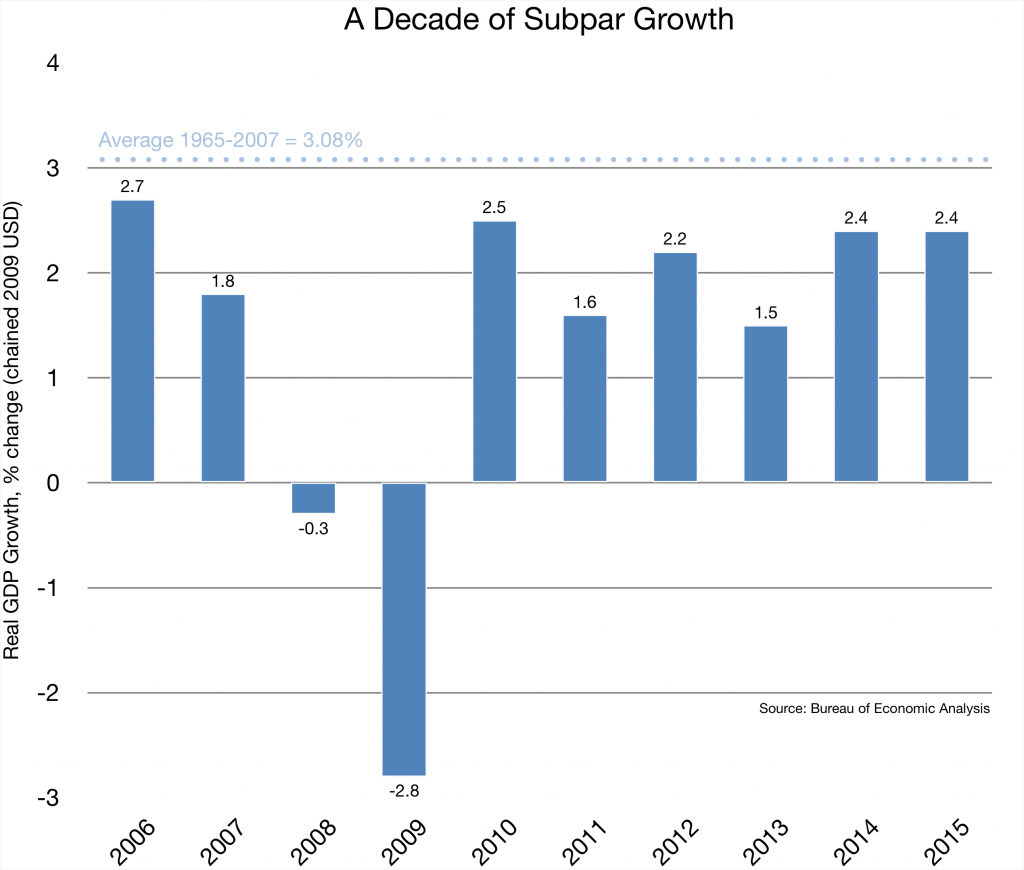

A decade of subpar growth

Here’s a supplement to our previous post on economic growth scenarios, another way to look at the past decade.

Busting out of the 1.9% economy

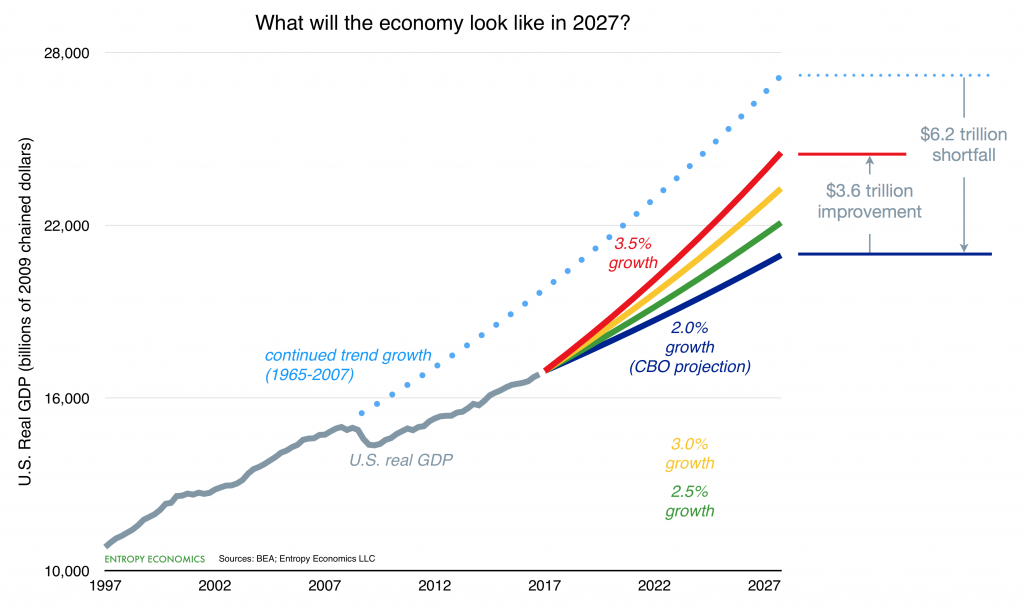

The Congressional Budget Office yesterday published its annual 10-year economic outlook. It says, essentially, the economy will continue expanding for the coming decade at the tepid pace of the last decade. It predicts a slow-growth “new normal” of 1.9% annual expansion extending through 2027. If nothing changed, CBO might very well be correct. Yet it’s possible, even likely, that economic policy will change more in the next few years than any time since the early 1980s, maybe even since the 1930s.

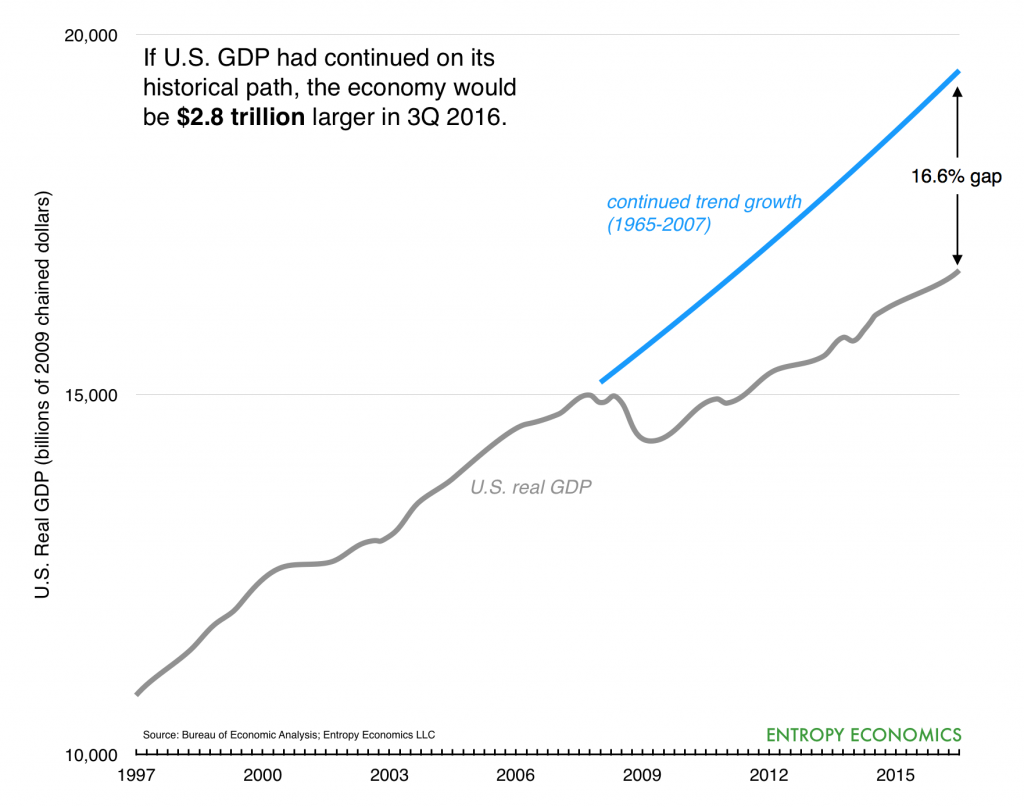

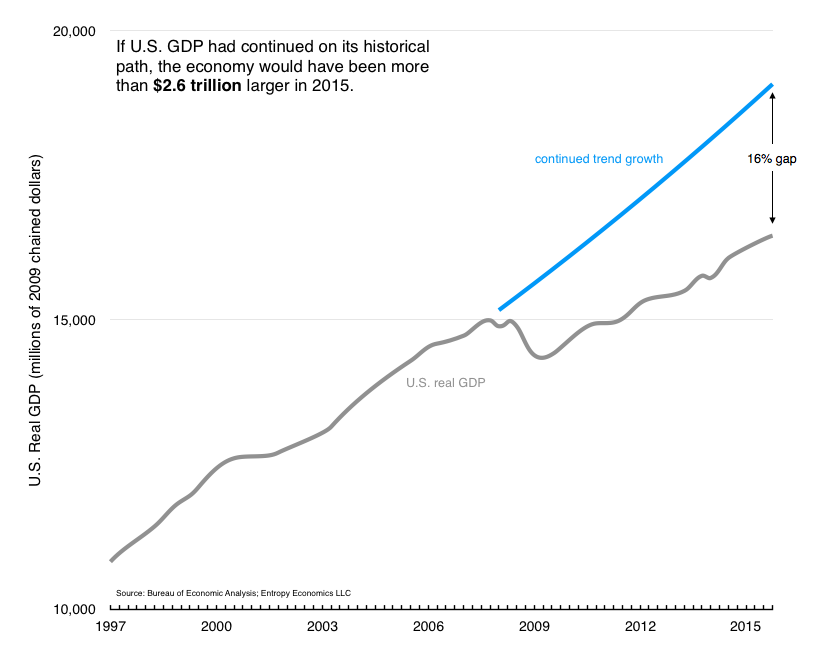

CBO projects growth of 2.3% this year, then 2.0% in 2018, 1.7% in 2019, 1.5% in 2020, 1.8% in 2021, and 1.9% from 2022-2027. It’s a tragic outcome if it comes to pass. We see below what a 1.9% economy got us over the last decade: a gigantic growth gap of around $2.8 trillion in lost output, compared to what we might have expected.

A continuation of the new normal would only compound this shortfall, compared to our economy’s likely potential. In fact, CBO also includes in its latest report an appendix showing the potential effects of productivity growth *even slower* than its central estimate. To be fair, CBO is not predicting slower productivity, just offering useful heuristics to estimate the economic and budgetary effects of slower productivity growth. I think, however, that variance from the baseline scenario will be just the opposite — that productivity growth will surprise to the *upside* over the next 10 years.

The chart above illustrates these scenarios over the coming decade. The gray line is actual real GDP. The light blue dotted line is what the economy would have looked like had the U.S. continued growing at its historical rate after 2007. The growth gap today, at the start of 2017, stands at something like $2.8 trillion (the difference between the gray line and the blue dotted line). Others, using more conservative assumptions, find a gap of around $2 trillion, still a huge shortfall.

The dark blue line is roughly CBO’s projection for the next 10 years — around 2.0% annual growth — which is a continuation of the roughly 2% we’ve experienced in the current expansion. If CBO is correct, the U.S. economy will be something like $6.2 trillion smaller in 2027 compared to what we might have expected in 2007.

The green line shows 2.5% growth, and yellow shows 3.0%, which was about the U.S. average between 1965 and 2007.

The red line shows 3.5%, which many analysts believe is too ambitious a scenario. They think, with some reason, the U.S. economy is maturing and is on a permanently lower growth path than before. Perhaps in the very long term 3.5% is too optimistic. Who knows? But I think the U.S. can grow at 4% or more for the next few years before returning to the longterm average of 3%, which could sum to around 3.5% over the next decade. I say this for three reasons:

(1) The U.S. economy never really recovered from the financial panic and Great Recession. Investment has been weak, job growth was steady but very slow, and entrepreneurship has been wanting. The overall policy environment — on taxes, regulation, and monetary management — has discouraged growth. There’s lots of room to make up.

(2) The policy environment could improve dramatically over the coming years. Big reforms of the tax code and regulatory approaches across dozens of agencies could unleash investment and innovation that’s been pent up for years. Such huge potential policy changes will not only allow us to “catch up” some lost growth from the last decade but can also boost our top-line frontier of innovation and thus growth potential. (There are also of course policy risks, such as rising protectionism, and global risks, such as China’s fragile economy. Yet I think the balance tilts toward growth.)

(3) The productivity plunge of the last decade is nearly over. I believe, based on what I’m seeing across the technology landscape, we are the cusp of a productivity boom. I will have much more to say about this in a forthcoming paper. But if it happens, the productivity increases I’m estimating could lift annual economic growth by nearly a percentage point over the coming decade.

Combining these three factors, I think the red 3.5% growth scenario through 2027 is possible. It would represent a $3.6 trillion GDP improvement over CBO’s estimate for the 2027 economy.

— Bret Swanson

Happy 250th birthday, Jean-Baptiste Say

JB Say, 1767-1832

Jean-Baptiste Say was born 250 years ago, on January 5, 1767.

Say translated Adam Smith into French, wrote his own *Treatise on Political Economy* in 1803, and coined the term entrepreneur. He worked at a life insurance company in England and established his own cotton spinning mill in France, employing as many as 5,000. His “Law of Markets” – later known as Say’s Law – was a foundation of classical and neoclassical economics, a contravention of Malthusian pessimism, and later a chief target of Keynesian antagonists.

Peter Drucker began the first chapter of his book *Innovation and Entrepreneurship* by quoting Say.

“The entrepreneur,” said the French economist J.B. Say around 1800, “shifts economic resources out of an area of lower and into an area of higher productivity and greater yield.”

Drucker later continued:

“Joseph Schumpeter was the first major economist to go back to Say. In his classic *The Theory of Economic Dynamics,* published in 1911, Schumpeter broke with traditional economics – far more radically than John Maynard Keynes was to do twenty years later. He postulated the dynamic disequilibrium brought on by the innovating entrepreneur, rather than equilibrium and optimization, is the ‘norm’ of a healthy economy and the central reality for economic theory and economic practice.”

Here’s is Thomas Sowell’s book *Say’s Law.*

Here is Steven Kates’s book *Say’s Law and the Keynesian Revolution,* and a video of a Kates lecture on the topic.

Here’s John Maynard Keynes’s book *The General Theory,* which was in significant part an attempt to refute his own clever misstatement of Say’s Law.

Here is Mark Skousen: “Say’s Law is Back.”

And here is the @JBSay twitter account (me).

— Bret Swanson

Reasons for optimism in 2017?

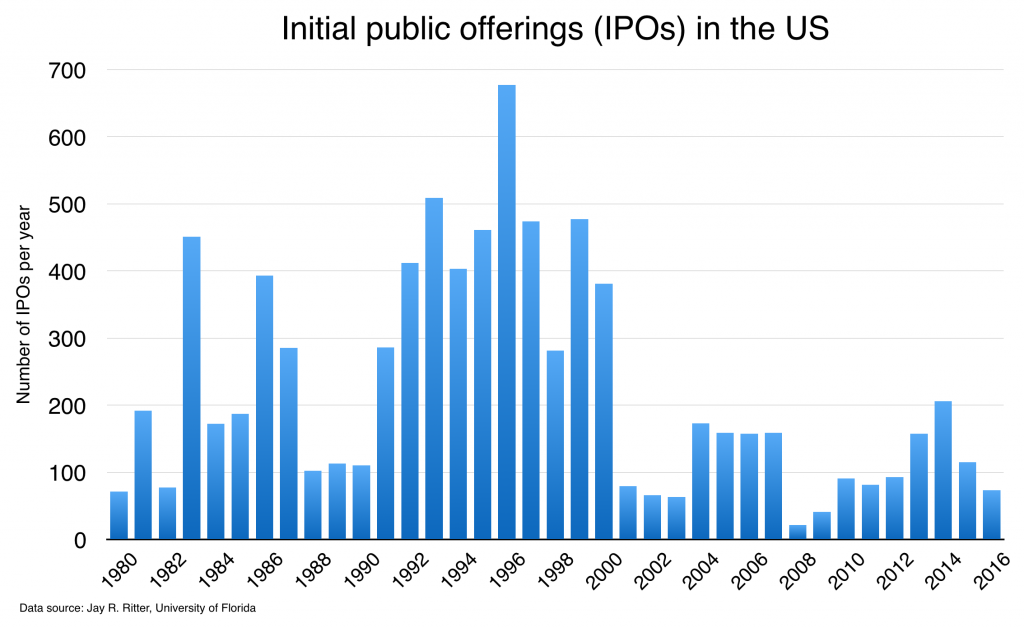

A new policy direction in 2017 could substantially boost the economy. Last week I commented on the 15-year IPO winter and the possibilities for a revival of public equity financing of growing firms.

More broadly, my research for the last 10 years at the U.S. Chamber Foundation has focused on the collapse of economic growth, summarized in the chart below. (See also, for example, The Growth Imperative, Beyond the New Normal, The Growth Agenda, etc.)

This $2.8-trillion “miss” translates into millions of lost job-years and stagnant incomes for most occupations in much of the country.

I’ll have lots more to say about the sources of — and potential solutions to — this growth gap in the coming weeks and months. For now, we highlight these severe shortfalls to reinforce just how crucial a new growth agenda is.

The Internet media free-for-all

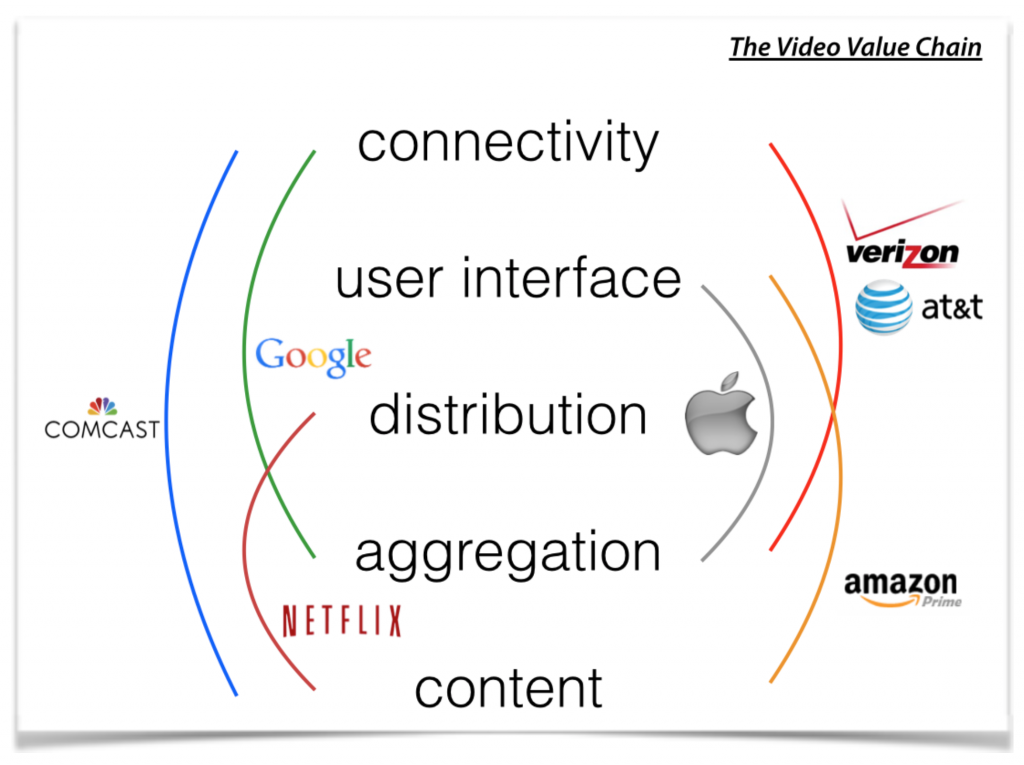

Tomorrow, a host of Silicon Valley firms will visit Trump Tower for a meeting with the President-elect. Last week, AT&T and Time Warner visited Capitol Hill to testify about their proposed merger. These diverse companies build lots of things, from software to networks to original content, but they also have one thing in common. Increasingly they are all vying for bigger chunks of the video market, and in the process they are creating an entirely new media universe.

Too often when policymakers look at these companies, individually or in small sets, they see only what it right in front of them, rigidly defined and static, or even stereotypes of what these companies were a generation ago. But these companies — and the markets in which they play — are changing every day.

Several years ago, in a report called “Life After Television,” we noted that the YouTube and Netflix phenomena were only just the most obvious and earliest manifestations of the Web video revolution. We noted that, yes, the more abundant bandwidth of cable TV and then satellite had been improving the video market for years, but that even bigger changes were coming. This process, we said, would be intense, and messy, and often exhilarating.

Broadband and the Web have now super-charged all these phenomena. We enjoy far more choice and diversity, and the spectrum of quality is broader still. The producers, delivery channels, and business models for video are also multiplying (and in some cases recombining and overlapping in surprising ways). We are only in the middle of the beginning of what will be a decade-long process of sorting out the video content, creation, distribution, aggregation, user-interface, viewing, advertising, and subscription markets.

Here is the graphic we used to describe, in simplified form, the overlapping activities of firms competing in the video market, often approaching from very different angles and starting points.

Graphic describing simplified video value chain, circa 2014, in Life After Television.

The firms pictured are still at the center of the new media tussle. But others have joined the fray, and the battlefield is constantly shifting. Facebook, for example, was not even on our 2014 graphic, but in the subsequent two years it has become a giant player in the Web video (and thus advertising) market. At the time of our report, only Comcast covered the full spectrum, from connectivity to content. But in the meantime Verizon added content via its purchases of AOL and Yahoo, and AT&T is adding content with its Time Warner acquisition. Netflix and Amazon have only expanded as award-winning production houses of original content. Google and Apple, of course, continue to approach video with distinct business models — Google via advertising and the Web, Apple via a la carte and apps — but each remains a powerful player. And we are still only, perhaps, at the end of the beginning of this media reshuffling.

This new media world is emblematic of an even larger phenomenon of dynamic competition across the technology landscape. I described this even wider playing field in another report called “Digital Dynamism: Competition in the Internet Ecosystem,” which illustrated the multidimensionality of the market. This new market was characterized by intensive innovation, product differentiation, and cascades of competitive and complementary products and services.

The dynamism of the Internet ecosystem is its chief virtue. Infrastructure, services, and content are produced by an ever wider array of firms and platforms in overlapping and constantly shifting markets.

The simple, integrated telephone network, segregated entertainment networks, and early tiered Internet still exist, but have now been eclipsed by a far larger, more powerful phenomenon. A new, horizontal, hyperconnected ecosystem has emerged. It is characterized by large investments, rapid innovation, and extreme product differentiation.

There is both more competition, and more complementarity, than ever before. Which is why policymakers or pundits who are quick to shout “monopoly” in any of these contexts is almost surely wrong. Yes, some of these firms have large market shares in small portions of this overall digital world, but these share are often gained through real innovation, and even then they are often fleeting. These markets are way too fluid to assume anyone has a lock on any part of it, let alone a dominant position overall. So a merger of, say, AT&T and Time Warner, might to some look like “consolidation,” when in fact it potentially provides highly innovative and beneficial new competition in the online advertising business, where at the moment Google and Facebook are the biggest players.

It’s way too early to predict where all this will end up, let alone to dictate and end game.

Zero-sum thinking on zero-rating threatens 5G success

On Wednesday, the Senate Antitrust Subcommittee will take up AT&T’s pending acquisition of Time Warner (the owner of HBO and TBS, not the cable company). Congress has no direct role in merger approval, but the hearing will no doubt highlight the arguments for and against the merger that the Department of Justice, and possibly the Federal Communications Commission (FCC), will hear next year.

As odd as it may sound, I think the AT&T-TWX alliance is chiefly a 5G wireless infrastructure story. Time Warner, combined with DirecTV, will provide a huge amount of popular video content to act as a killer app for a new nationwide wireless infrastructure, not only delivering video to proliferating mobile devices but also competing with cable for residential TV and broadband subscribers.

While video may be the killer app, this 5G wireless network will also serve as the strategic platform for most of the rest of the economy, from connected and autonomous cars to health care to the retail and industrial Internet of Things (IoT). For an incoming administration focused on infrastructure and reviving the lagging sectors of our economy, 5G is attractive. It offers not only tens of billions of dollars of direct infrastructure investment and jobs (at no cost to taxpayers) but also a means to boost productivity and incomes in industries that so far have been left out of the information revolution.

Much of the opposition to the deal takes the vague and familiar form of big-is-bad. Among specific critiques of the deal, however, the most prominent is opposition to “zero rating.” Zero rating, or free data, is the practice of content firms paying for the data consumption of their viewers or listeners. Free data comes in different forms — some are like 1-800 toll-free numbers, other exempt sponsored content from data limits.

Critics worry that AT&T, like Comcast before it, will use zero rating to favor some content over other content, and the outgoing FCC is trying to pick a fight. Last week, AT&T launched its new DirecTV Now service, which delivers bundles of cable-like video channels over the internet and which won’t count against users’ AT&T data limits. You’d think the FCC would be thrilled with this new, attractively-priced, competitive offering. Yet the FCC promptly hit AT&T (and Verizon, which has a similar service) with letters skeptical of their free data programs.

The FCC’s attack on free data is probably legally indefensible, but it is also economically unsound. Opposition to zero rating is based on zero-sum fallacies, where one party’s gain necessarily means another party’s loss. If HBO or ESPN or Netflix or NBC or Spotify subsidize your consumption of their content, then you or other content firms must somehow lose, or so the theory goes.

But the opposite is true. What if most everyone can get more of what they want? This is the way innovation works. In competitive markets like mobile broadband and digital content, free data is additive. It’s positive-sum. By allowing content firms to contribute to the economic equation where they see a benefit, it promotes the consumption of more total data by consumers, their ability to access more third-party non-zero-rated content, and the ability to build faster networks. It’s a win-win-win for consumers, ISPs, and content providers.

Free data is likely to be a widely used business model for connected cars, health care and educational apps, and the Internet of Things. And so proscribing the use of this commonplace business model would not only hurt digital content but also the emerging apps and services we are planning to build using 5G networks.

There’s lots more to say on these topics, but opposing a merger based on refusing free data for consumers is unlikely to be a winning argument.

Google Fiber pull-back shows broadband is difficult. But 5G will make it much easier.

USA Today reports that:

Google Fiber is halting its rollout in 10 cities and laying off staff as its chief executive Craig Barratt steps down, dealing a major setback to the Internet giant’s ambitions of blanketing the nation in super-speedy Internet.

Several years ago, Google Fiber was the darling of both Silicon Valley and most of Washington’s tech policy wonks. It was supposed to bring “gigabit speeds” to supposedly woefully underserved American consumers. The facts were more complicated. It turned out existing broadband firms were already investing hundreds of billions of dollars in wired and wireless broadband, and the U.S. topped the world rankings in the most important measures of Internet performance. Google Fiber’s demise, or pause, or whatever it turns out to be, shows that large scale infrastructure projects are hard. And expensive. And competitive. Especially when deploying fast-changing technologies. And especially when the costs of regulation are rising.

Which points to an ironic facet of this news. At the Wall Street Journal‘s annual WSJ.D conference yesterday, AT&T CEO Randall Stephenson plainly acknowledged Google’s victory in the biggest tech policy debate of the last 15 years: “On neutrality. You guys from Google, you won. It’s done.” Yet the sad irony is that Google’s “win” on policy — the imposition in 2015 of old and voluminous monopoly telephone rules onto modern broadband — made Google’s own broadband deployment efforts even more difficult. We long said that Title II regulation would make broadband less competitive, and Google’s exit of the business is evidence of this effect.

What regulation taketh in terms of innovation and investment, however, technology can in some significant portion often give back. Enter 5G wireless.

Fifth generation wireless, or 5G, is a suite of technologies that will be the foundation of the Internet, and of most of the economy, for the next 20 years. It includes more advanced air interface protocols, new “software defined” network architectures, use of huge new swaths of high-frequency spectrum, and deployment of millions of small cells, all of which will dramatically expand coverage and capacity. But not just for mobile. 5G will also power connected cars and the Internet of Things. It could even become a real competitive offering for fixed residential broadband, delivering both interactive Web video and TV-like high-definition video the way only cable and fiber-to-the-home do today.

It is this facet of 5G that AT&T and Time Warner have emphasized over the last few days since announcing the $85-billion merger of the two firms. Verizon and AT&T over the last decade have built fiber networks into neighborhoods where it made financial sense. But as Google learned the hard way, the business case for fiber is tough even in densely populated urban or suburban areas, let alone exurbs or rural communities. (Google does deserve credit for the progress it made in prying open the local regulatory bottlenecks that too often discourage broadband deployment — things like burdensome infrastructure permitting and local cable franchise rules. Larger broadband firms are now taking advantage of these beneficial bottleneck openings to lay more fiber deeper into communities and neighborhoods across the country.)

A key component of 5G is the opening up of huge amounts of spectrum, at far higher frequencies than are used today for mobile wireless. Today’s mobile devices send and receive signals mostly in the 1-2 gigahertz range. Most Wi-Fi signals are in the 2.4 and 5 GHz bands. But 5G will make use of bands in the 20, 30, and even 70 GHz range. These higher frequencies contain large blocks of mostly unused bandwidth that can transmit more data far faster than today’s mobile cell networks. In a neighborhood setting, fiber-connected small cells could blanket not only hundreds of home receivers but also thousands of mobile devices. But bringing fiber to the neighborhood is far more cost-effective than taking it all the way into the home.

5G could be powerful enough to deliver a video service on par with cable TV/broadband. Satellite will still have an important role for high definition TV, but 5G can overcome satellite’s limited capacity for interactivity (given the latency incurred over the 46,000-mile round trip to space and back).

This new competitive broadband service might be enough to push the AT&T-TW partnership over the line with regulators. And it should also serve as a warning to future market meddlers at the FCC: technology is almost always far more powerful, and pro-consumer, than clever attempts to shape yesterday’s markets.

What’s behind the stunning decline in publicly traded U.S. firms?

An underreported story of the last two decades is the sharp decline in the number of publicly traded U.S. firms. In 1996, U.S. stock markets boasted 7,322 listed firms. By 2015, however, that number had dropped by more than half, to 3,200. If we adjust for population, the U.S. had 2.2 public firms per hundred thousand people in 1975, but today that number has fallen to 1.1 public firms per hundred thousand people. The peak in 1996 was 2.7 public firms per hundred thousand.

There’s been an initial public offering (IPO) winter for the last 15 years. We know that Sarbanes-Oxley, the set of post-Enron financial regulations enacted in 2002, substantially boosted compliance burdens for public companies and, at the margin, discouraged listing publicly. But the drop in total public listings began before Sarbox and was in fact coincident with the late-1990s boom of technology IPOs. The mid-1990s peak of tech IPOs almost assuredly skews the chart, and yet the U.S. still has fewer public firms today than it did 40 years ago.

So I still have more questions than answers. For example:

Over the past few decades, the rate of new businesses formed in the U.S. has fallen. Is the plunge in the number of public firms partly a result of the slowing rate of net business starts? Or perhaps just the reverse: Is reduced new firm formation a function of a less healthy public equity market?

Does this represent a benign shift in the way companies are financed? In other words, are private markets – bank loans, venture capital, private equity – now so large and sophisticated that they can replace and compensate for shrinking public markets? Or are weaker public markets starving businesses of funding?

Is the drop a function of slower economic growth overall? Or is it a cause of slower growth? In a similar vein, is the drop a cause or effect of the recent productivity plunge?

Are there a significant number of foreign firms that used to be listed on U.S. stock markets now listed on their home markets?

Is the reduced number of public firms a result of a higher rate of mergers and acquisitions (M&A)? And if so, is higher M&A activity a secular shift in industrial organization? Or is it a response to policies that encourage M&A and discourage firm independence?

Does the knowledge economy, which rewards network effects and scale economies, tend toward a smaller number of winner-take-all firms? In a distinct but related phenomenon, might modern communications tools allow firms to more efficiently integrate than was previously possible? Or might these network and scale effects produce both winner-take-all mega-firms (Apple, Google) and also lots of complementary firms (start-up app developers, graphic designers, etc.), with the problem lying elsewhere?

Are private firms better at investing and innovating for the long term, given the regulatory incentives faced by public firms and investors to focus on the short term? (Sarbox and other “fair disclosure” [FD] rules, for example, are designed to increase transparency and provide a level information playing field for all investors. But in practice the FD paradigm concentrates information releases into discrete quarterly announcements. It thus may contribute to the dreaded “short-termism” – a myopic focus on next month’s earnings rather than long term innovation. Because real information is less available, it also encourages short-term quantitative computer trading over fundamental analysis and long-term investing.) If so, private firms may be a solution to the information desert afflicting public markets.

Is the public firm reduction concentrated in particular industries – manufacturing, retail, health care, finance, technology, etc.? Or is it spread evenly across industries?

Does globalization mean that former U.S. firms now spread around the world just aren’t replaced by domestic firms? The timing with the rise of China suggests perhaps this is a factor. And yet the world economy is not zero sum. Why couldn’t globalization, which allows for more specialization and growth, allow new types of American firms to replace the ones that “moved” abroad?

Is the tax code an important factor? For example, publicly traded firms fell after the 1986 tax reform (after which much income reporting was shifted away from corporate income and toward individual income), rose after the 1993 tax increase, and then fell again after the 1997 capital gains tax reduction. In addition, the U.S. corporate tax rate of 35% has, over time, become the highest in the developed world. We know U.S. firms keep several trillion dollars in retained earnings overseas because they can’t bring it home. Can corporate inversions, in which U.S. firms move abroad, at least notionally, often to escape punitive taxes, explain a significant part of the phenomenon?

How do fewer public firms affect R&D investment and employment? Is the fall in the labor force participation rate related?

What does the investment environment look like in a world of reduced public equity vehicles? How do equity markets behave with fewer domestic public firms but many more investors? How does this change affect individual retail investors, who don’t have much access to private markets, versus sophisticated investors who enjoy many more options, such as venture capital, private equity, M&A, and private credit?

The most comprehensive treatment of the topic comes from a paper by Gustavo Grullon, Yelena Larkin, and Roni Michaely. They attempt to tease out some, but not all, of these questions and focus especially on the market concentration issue. They find that “product market concentration has increased across most industries,” profits have increased because of “increased market power,” and “competition could have been fading over time.”

A new report from the White House Council of Economic Advisors picks up this theme and laments higher firm concentration and less competition in the U.S. economy. The CEA says more rigorous antitrust enforcement and agency specific regulation could help promote competition.

And yet the CEA report ignores perhaps the most important factor in falling competition: regulation itself. Dodd-Frank has made the big banks bigger and reduced the number of small community banks. The Affordable Care Act (ACA) accelerated the consolidation of hospitals, clinics, and other health care providers into massive health care systems. The ACA has also reduced product and supplier choice, and boosted premiums, in the health insurance market. Washington is trying its best to shut down private colleges and other non-traditional educational offerings. Its “war on coal” has been successful at killing coal companies and thus reducing energy competition. And the Federal Communications Commission’s new Title II net neutrality rules – which were designed for a monopoly industry! – are likely to discourage new entrants into the wired and wireless broadband arena. I could go on.

If Washington had set out to frustrate entrepreneurship, reduce competition, and discourage public equity financing, it would have enacted policies much like the ones of the last 15 years. The entire apparatus of regulation and taxation, taken as a whole, has slowed the economy and thus the diminished the possibilities for smaller competitive firms to get started, expand, and perhaps go public.

No one knows what the “correct” number of public firms is. But we’d get a much better picture of that number by freeing competitors to compete and allowing the market to fund firms with the best mix of financing.

__________________

This post originally appeared at the U.S. Chamber Foundation blog – https://www.uschamberfoundation.org/blog/post/what-s-cause-and-effect-plummeting-public-firms.

The Indiana Primary

As a native Hoosier, born in La Porte, now living in Zionsville, I feel a responsibility to share my views on the upcoming primary between Ted Cruz and Donald Trump.

The nation is at a crucial inflection point – on the economy, the culture, and foreign affairs. As for the Republican Party, it will be running against a very weak Democratic candidate, and it has a historic opportunity to change the trajectory of the economy and right the dysfunction in Washington. If you are a Republican, or an independent or Democrat who’s dissatisfied with the nation’s current path, this is a big decision. The bottom line is that Ted Cruz would likely win in the fall, while Donald Trump would almost certainly lose in a historic wipeout. Even if Trump were to win, however, he would continue, not revise, Washington’s harmful policy path.

A few considerations:

1. If Indiana votes for Cruz, the nomination will be decided at the Cleveland convention in July. In that scenario, Cruz likely wins the nomination – and likely wins in November. Trump is a historically unpopular candidate beyond his narrow band of supporters. He is today losing to Hillary Clinton in Utah – UTAH! – the reddest of red states. Even his home-state New York victory was unimpressive. Hillary Clinton and Bernie Sanders each got more votes last week in New York than did Trump. Ted Cruz got more votes in Wisconsin than Trump got in giant New York. The idea that Trump puts New York and other blue states in play is thus silly. And he could easily lose traditionally Republican states – a red/blue wipeout. Voters who want to win in the fall should not succumb to the false idea that this nomination is over. Far from it.

2. Cruz has the best pro-growth economic agenda in decades (watch this interview on CNBC). The U.S. economy is stagnating under the weight of heavy taxation and regulation and misguided monetary policy. Cruz’s two chief priorities are (1) replacing the current abominable tax code with a simple flat tax and (2) repealing Obamacare and replacing it with a health system that’s personal, portable, innovative, and affordable – one that’s better for patients and doctors, not for bureaucrats. Combined with a dramatic shrinking of the regulatory state and a sane monetary policy, Cruz’s agenda would likely unleash waves of growth similar to, or even surpassing, the two decade boom of the 1980s and ’90s.

3. Cruz is razor sharp and principled and has effectively challenged Washington’s run-away spending and regulation. He’s selected an equally sharp running mate in Carly Fiorina, a technology executive who understands the economy, is a terrific communicator, and offers a bright and effective contrast with the Democratic nominee.

4. Trump, on the other hand, supports Washington’s run-away spending, taxation, and regulation. He supports single-payer government health care and, to the extent he knows or cares, supports much of the Democratic agenda. If implemented, his views on international trade could crash the economy. Trump is not a serious person. He is a showman without substance. To the extent he believes in anything beyond himself, he’s a big-government liberal progressive.¹

5. Some say Trump is a good businessman, but he’s a good businessman in the sense that Kim Kardashian is a good businesswoman. They are geniuses at grabbing attention with ridiculous and prurient stunts and turning celebrity into dollars. But celebrity is not leadership. Attention-grabbing stunts do not unite people to do big and important things. Any president by definition already has the world’s attention. It’s what you DO with that attention that matters. And Donald Trump has no clue what to do.

6. Voters should not reward dangerously juvenile behavior. Donald Trump insults women, minorities, and disabled people. When challenged, he calls people names and makes fun of their appearances. He rambles on about personalities and inane topics. Why? Because he has no clue about anything of substance. He dissembles (lies) almost constantly – pathologically, in fact. To the extent he can form a declarative sentence, he’ll switch positions three times in five minutes, and does so day after day. He won’t debate on substance because he knows he’ll get clobbered. Most politicians are of course ambitious and self-involved. But the best among them at least aspire to do important things. For Trump, he is that important thing. (For Cruz, surely an ambitious person, those things are reviving the economy, cleansing a corrupt Washington, D.C., and restoring the Constitution.) For Trump, there is nothing beyond himself. His entire life is an exercise in ego inflation. This is Trump’s ultimate self-aggrandizing confidence game. He’s trying to fool people into giving him more fame than ever. Trump is a vile, vain, insubstantial, insecure, dishonest, divisive, dangerously ignorant con artist.

7. Some tactical considerations. If you are interested in winning in the fall, vote Cruz. If you don’t like Trump and think you like John Kasich, I’d suggest you should still vote Cruz. Only two people can win the GOP nomination – Cruz or Trump. A vote for Kasich is thus a vote for Trump.

8. Read this terrific column by George Will, one of our most sober and smartest defenders of liberty. Two excerpts:

“Ted Cruz’s announcement of his preferred running mate has enhanced the nomination process by giving voters pertinent information. They already know the only important thing about Trump’s choice: His running mate will be unqualified for high office because he or she will think Trump is qualified . . . .”

“Trump would be the most unpopular nominee ever, unable to even come close to Mitt Romney’s insufficient support among women, minorities and young people. In losing disastrously, Trump probably would create down-ballot carnage sufficient to end even Republican control of the House.”

Let’s finish on a happy note. Despite the bizarre and frustrating election season, the fact is we still have a very good shot to right the American ship . . . If Indiana does the right thing on Tuesday.

______________

¹ I corrected this description to big government “progressive” because of Trump’s authoritarian views on free speech, for example, and other Constitutional and natural liberties.

* Here are my previous ramblings on the genesis of the Trump phenomenon – “My Two Cents on Trumpism.”

** UPDATE: This story from Tuesday, May 3 – “Trump accuses Cruz’s father of helping JFK’s assassin” – reinforces my point about the vast gulf between Donald Trump and reality. He is, as I wrote above, pathological.

What’s the best way to help the middle class? Targeted benefits or an economic boom?

On Sunday, Ross Douthat of the New York Times questioned the courage of Speaker Paul Ryan, asking why he hasn’t stood up more forcefully against Donald Trump. I, too, wish Ryan and other GOP leaders would (or could) explicitly denounce or otherwise frustrate the Trump candidacy. The complexity and delicacy of Ryan’s task, however, should not be underestimated. In today’s environment, might denunciations from the Speaker of the Establishment actually fuel Trump’s fire?

If I sympathize with Douthat’s frustration at GOP “paralysis,” however, I confess befuddlement at Douthat’s key takeaway: that the GOP should consider abandoning a growth-oriented agenda in favor of more Trump-like policy pandering.

One reasonable response to this kind of stark challenge, this incipient revolution, would be soul-searching and a course correction. Trump would not have gotten this far, would not have won so many votes — especially working class votes — if the Kempian vision had delivered fully on its promises, if mass immigration, free trade, deregulation and upper-bracket tax cuts had really been the prescription for all economic ills.

This is baffling. Douthat’s premise is that Ryan’s pro-growth agenda was enacted, and failed. Where has he been for the last 15 years?

Deregulation? The last two administrations, but especially the Obama administration, have built new mountains of regulation in finance (Sarbox, Dodd-Frank), energy (Clean Power Plan, ad infinitum), health care (Obamacare), education, the Internet (Title II), and a host of executive actions.

Tax cuts? The George W. Bush administration mildly cut dividend and capital gains rates the top individual rate, but Obama has mostly reversed those actions and added new taxes as well. The top tax rate is thus 15 points higher than the Reagan-“Kempian” 28% (more like 20% when accounting for state taxes), and much of the rest of the world has in the interim leapfrogged the U.S. in corporate and individual tax policy.

Trade? The Bush administration ran a weak dollar policy explicitly to help U.S. manufacturers and counter the China “threat,” just as Trump might have advised. But the effect was to inflate energy and home prices and contribute to the financial crisis.

Douthat is also worried about Ryan’s proposed entitlement stinginess. But the George W. Bush administration substantially expanded Medicare through the Part D dug benefit, and other safety net programs like food stamps have exploded.

The idea that the ambitious agenda of Ryan, who has been Speaker for a couple months, has not worked is just weird. We’ve been doing just the opposite for the last decade and a half, and the economic results show it.

<

<

Douthat has written thoughtfully for many years on the plight of the middle class and, with his coauthor Reihan Salam, presciently urged the GOP to focus on the growing ranks of citizens, invisible to Washington, who now appear to be voting for Trump. For the last several years, conservatives have engaged in a polite debate over the best way to help. Douthat and a host of very smart and admirable policy thinkers have advocated something they call reform conservatism, earning the name Reformicons. The theoretical case, most powerfully explicated by Yuval Levin, emphasizes the importance of human capital – fertility, family, education – and the civic institutions needed to support these things. The cost of raising productive children is rising (I know, I’ve got four between the ages of 8 and 14), and the experiences of Japan, Italy, and other aging societies should be a warning. The resulting policy agenda, however, has proved less inspiring. The basic idea is to more narrowly focus various subsidies, entitlements, and tax benefits on the invisible low- and middle-income groups and explicitly renounce “tax cuts for the rich.”

The Reformicons like to needle growth advocates that they are nostalgic for Ronald Reagan and the 1980s, that we need to modernize our economic program. But I think they have it backwards. Reform conservatism appears to be mostly a rebranding of George W. Bush’s compassionate conservatism – big spending, more entitlements, a focus on targeted tax cuts and benefits, trade protectionism to help blue collar manufacturing, such as the weak dollar policy and Chinese steel tariffs, and efforts to improve human capital, such as No Child Left Behind. It was all well-intentioned, but not so successful. Especially for the Americans those programs sought to help.

I think the Reformicons should be commended for their focus on the middle class in “real America” and especially for their emphasis on human capital. But their attacks on a 21st century growth agenda these last few years may be endangering the very people for whom they are fighting. No doubt, the decline of cultural capital that Charles Murray warned of in Coming Apart is crucial and ever more apparent. But tax credits are unlikely to bring the type of cultural renewal that’s needed. And adopting Democratic tax policy and tax rhetoric isn’t going to win economically or politically. Another substantive problem is that as we build up means-tested credits and benefits for lower and middle income workers, we also impose high marginal tax rates on them due to phase outs. Economics isn’t everything. But the biggest drivers of well-being for moderate income Americans, including the opportunity to escape the cultural vortex and form robust civic connections, are still innovation, productivity, and economic growth.

“Sclerotic growth is the overriding issue of our time,” writes economist John Cochrane.

From 1950 to 2000 the US economy grew at an average rate of 3.5% per year. Since 2000, it has grown at half that rate, 1.7%. From the bottom of the great recession in 2009, usually a time of super-fast catch-up growth, it has only grown at two percent per year2. Two percent, or less, is starting to look like the new normal.

Small percentages hide a large reality. The average American is more than three times better off than his or her counterpart in 1950. Real GDP per person has risen from $16,000 in 1952 to over $50,000 today, both measured in 2009 dollars. Many pundits seem to remember the 1950s fondly, but $16,000 per person is a lot less than $50,000!

If the US economy had grown at 2% rather than 3.5% since 1950, income per person by 2000 would have been $23,000 not $50,000. That’s a huge difference. Nowhere in economic policy are we even talking about events that will double, or halve, the average American’s living standards in the next generation.

I’ve been shouting these ideas from the rooftops for the last five years (see The Growth Imperative, The Growth Agenda, and many more). Although I had no idea Donald Trump would run for office, let alone gain any following, I wrote a memo in 2014 warning of the social implications of an underperforming economy.

“The consequences for human welfare involved in questions like these,” the Nobel laureate economist Bob Lucas wrote in 1988, referring to the topic of economic growth, “are simply staggering: once one starts to think about them, it is hard to think about anything else.” As Lucas explored what made some nations wealthy and others less so, he looked at a number of developing countries and reported the stark differences in growth rates and thus standards of living. Between 1960 and 1980, India, for example, grew 1.4 percent per year, while South Korea grew at an annual rate of 7.0 percent. At those rates, Lucas concluded, “Indian incomes will double every 50 years; Korean every 10. An Indian will, on average, be twice as well off as his grandfather; a Korean 32 times.”

Einstein referred to the same idea when he quipped — apocryphally, it turns out — that compound interest is the most powerful force in the universe. Whoever put those words in Einstein’s mouth was smart. The same idea is behind Moore’s law of microchips. Compound growth is transformative. It trumps all — maybe even a poisonous political environment.

The slow recovery from the Great Recession, on the other hand, is capping middle class incomes, driving Americans out of the workforce, piling up debt, and straining our social fabric. The politics of “inequality” and resentment are a natural outgrowth of such a malaise and can lead to a downward policy spiral if leaders do not offer an optimistic, compelling alternative.

The economy has not reached 3% growth, our historical average, in any of the last 10 years. Not because Paul Ryan’s growth agenda has failed but because in too many cases we did just the opposite.

There is of course no guarantee of 3% growth. It is merely an historical average. And yet there’s lots of evidence that our economy is operating well below potential. Yes, some structural factors like demographics are weighing on growth, but all the more reason to address the policy obstacles holding us back. Cochrane and John Taylor both think with better tax and regulatory policy we could grow at 4% for several years before returning to the long-run path around 3%. By all means, if we improve tax and regulatory policy to unleash the economy and we find pockets of Americans still struggling because of structural defects, let’s work to help those citizens in targeted ways. But it makes little sense to insist on, as the centerpiece of your program, and at the expense of a broader growth agenda, a host of complicated programs, credits, and subsidies seeking to ameliorate the very real effects of a stagnant economy: joblessness, underemployment, a stall in wages, and many resulting social problems.

Some of the Reformicons say its really regulation that’s holding the economy back, so we shouldn’t address taxes. Over-regulation is indeed a massive problem. But we don’t have to choose one or the other. We need to both downsize and modernize the Administrative State and reform the tax code.

And on language: The goal is tax reform — not tax cuts for this group or that. The objective is a new tax code — radically simpler, fairer, and pro-growth. Insisting that Republicans match the Democrats in a pledge against any tax reductions for anyone making $250,000 or more is self-defeating. It adopts the framing of big government advocates. And it makes tax reform impossible. Even corporate tax reform, which the Reformicons support, will reduce taxes for those making more than $250,000. So it appears to be little more than political capitulation that will do nothing to help the invisible Americans they so admirably would like to lift up. The Tax Foundation shows that tax reforms proposed in this campaign would deliver big benefits in jobs and wage growth while boosting GDP and delivering needed government revenues. Let’s not give up before we’ve begun.

_____

“Sclerotic growth is the overriding economic issue of our time.”

– John Cochrane

_____

Supreme’s take Apple-Samsung case

The Supreme Court today said it will hear the Apple-Samsung dispute over the “total profits” question in design patent cases. Specifically, the Court said it will address only question 2 from the cert petition:

Where a design patent is applied to only a component of a product, should an award of infringer’s profits be limited to those profits attributable to the component?

This is good news. It means the Court recognizes patent law from the 1800s often does not work in the modern high-tech economy. The Court can help clarify the law so we get more real innovation and less clever, predatory litigation. The patent reformation continues.

We wrote about the case here: Will Apple-Samsung Case Help Clarify Patent Law?