“If our brains were simple enough to understand, we would be too dumb to understand them.”

Meltdown in Iceland

Michael Lewis does it again, telling the story of little Iceland’s collapse with all the comedy required to endure such tragic times.

There’s a charming lack of financial experience in Icelandic financial-policymaking circles. The minister for business affairs is a philosopher. The finance minister is a veterinarian. The Central Bank governor is a poet.

But don’t feel bad, Iceland. Our central bankers and finance ministers are trained monetary geniuses. And they can match your meltdown any day of the week.

Black swans? Or black crows?

Nassim Taleb is moving along just fine with an elegant critique of banking’s misaligned incentives . . .

In fact, the incentive scheme commonly in place does the exact opposite of what an “incentive” system should be about: it encourages a certain class of risk-hiding and deferred blow-up. It is the reason banks have never made money in the history of banking, losing the equivalent of all their past profits periodically – while bankers strike it rich. Furthermore, it is that incentive scheme that got us in the current mess.

Take two bankers. The first is conservative. He produces one annual dollar of sound returns, with no risk of blow-up. The second looks no less conservative, but makes $2 by making complicated transactions that make a steady income, but are bound to blow up on occasion, losing everything made and more. So while the first banker might end up out of business, under competitive strains, the second is going to do a lot better for himself. Why? Because banking is not about true risks but perceived volatility of returns: you earn a stream of steady bonuses for seven or eight years, then when the losses take place, you are not asked to disburse anything. You might even start again, after blaming a “systemic crisis” or a “black swan” for your losses.

. . . But then, after showing how easy it is for bank management to capture short-term gains without worrying about long-term risks, Taleb concludes that

This is prompting me to call for the nationalisation of the utility part of banking as the only solution in which society does not grant individuals free options to look after its risks.

It’s a big leap from misaligned incentives to only the government can run banks. Doesn’t the expert theoretician of the highly improbable Black Swan understand that highly centralized governments are most often the cause of devastating Black Swan events? The only difference being: we shouldn’t really even call them Black Swans in the case of government failure. These events are not uncommon or unpredictable. The inherent difficulty and high-frequency failure of highly centralized bureaucracies managing dynamic systems is so common and predictable, in fact, that we might call them Black Crows.

We can do much better than nationalizing the banks. Boards should obviously reform compensation practices. Today’s shareholders have been mostly wiped out. The shareholders of the “next banks” won’t soon forget. But most crucially we should amend the wildly incoherent monetary policy regime that does more than any other private or government action to misalign incentives. During credit bubbles, dollars are easily vacuumed up by the financial industry. In a very real sense, they would be irresponsible not to exploit the Fed’s explicit free-lunch program of accommodation “for a considerable period.” Remember, Chairman Greenspan virtually ordered Wall Street to lever up.

A stable currency is the ultimate disciplinarian, the incentive aligner par excellence.

Update: See Taleb and Nobel psychologist/behavioral economist Daniel Kahneman discuss these topics at length here.

Mark to Mayhem, Part IX

Brian Wesbury and Bob Stein make yet another strong argument against the mark-to-market accounting regime:

The history seems clear. Mark-to-market accounting existed in the Great Depression, and according to Milton Friedman, who wrote about it just 30 years after the fact, it was responsible for the failure of many banks.

Franklin Roosevelt suspended it in 1938, and between then and 2007 there were no panics or depressions. But when FASB 157, a statement from the Federal Accounting Standards Board, went into effect in 2007, reintroducing mark-to-market accounting, look what happened.

Two things are absolutely essential when fixing financial market problems: time and growth. Time to work things out and growth to make working those things out easier. Mark-to-market accounting takes both of these away.

The “Gaussian copula” crash

Wired profiles the formula that killed Wall Street.

“Innovation isn’t dead.”

See this fun interview with the energetic early Web innovator Marc Andreesen. Andreesen is on the Facebook board, has his own social networking company called Ning, and is just launching a new venture fund. He talks about Kindles, iPhones, social nets, the theory of cascading innovation, and says we should create new “virtual banks” to get past the financial crisis.

The Three-week Collapse

Larry Lindsey with a good summary of the quick confidence collapse in Obama’s new economic plans.

The Geithner announcement was repeatedly put off while each of the options was publicly discussed. In the end the political decisionmakers decided there was no politically acceptable decision. But expectations had been building, stoked higher with each postponement of the speech. When Geithner finally spoke and by omission essentially admitted that the Obama administration hadn’t come up with a solution, the stock market plummeted.

But it wasn’t only the stock prices of America’s publicly traded companies that collapsed. So did the stock of the Obama administration. A discredited stimulus package followed by an overly hyped but largely vacuous bank-rescue speech proved to be too much. The mainstream media, which had given Obama a free ride since the election, turned on their choice. In the space of just over three weeks, Obama and company squandered the greatest stock of political capital any president since Lyndon Johnson had inherited from an election.

Dollar Standard Crucial

Stanford’s Ronald McKinnon, who I cited in my recent Wall Street Journal article on China, echoes my view:

Indeed, as the world goes into a severe economic downturn, the threat of beggar-thy-neighbor devaluations becomes acute — as in the 1930s. Stabilizing the exchange rate between the world’s two largest trading countries could be a useful fixed point for checking the devaluationist proclivities of other nations around the world.

Kessler may be crazy. But mark-to-market’s absurd.

Of the Treasury’s long-awaited non-plan bank plan, Andy Kessler writes, “Mr. Geithner should instead use his ‘stress test’ and nationalize the dead banks via the FDIC — but only for a day or so.”

Then,

strip out all the toxic assets and put them into a holding tank inside the Treasury. . . . inject $300 billion in fresh equity for both Citi and Bank of America. Create 10 billion new shares of each of the companies to replace the old ones. The book value of each share could be $30. Very quickly, a new board of directors should be created and a new management team hired. Here’s the tricky part: Who owns the shares? Politics will kill a nationalized bank. So spin them out immediately.

Some $6 trillion in income taxes were paid by individuals in 2006, 2007 and 2008. On a pro-forma basis, send out those 10 billion shares of each bank to taxpayers. They paid for the recapitalization.

Each taxpayer would get about $100 worth of stock for each $1,000 of taxes paid. Of course, each taxpayer has the ability to sell these shares on the open market, maybe at $40, maybe $20, maybe $80. It depends on management, their vision, how much additional capital they are willing to raise, the dividend they declare, etc. Meanwhile, the toxic assets sitting inside the Treasury will have residual value and the proceeds from their eventual sale, I believe, will more than offset the capital injected. That would benefit all citizens, not the managements and shareholders who blew up the banking system in the first place.

Is Kessler crazy? Well, maybe. In his own creative and boisterous way. But not nearly so crazy as Washington’s fumble-bumble these last few months. I’d much prefer Kessler’s out-of-the-box plan to D.C.’s muddle.

What becomes clearer every day is that all the government’s efforts, from the AIG “bailout” to TARP 1.0 and TARP 2.0 onward, have essentially been efforts to get around the terribly destructive interaction of “mark-to-market” accounting and regulatory capital requirements. A few keen observers — David Malpass (I), Brian Wesbury (I, II, III, IV), Steve Forbes (I, II) — have made this point from the start. But the government and most economists clung stubbornly to “fair value” in an apparent attempt not to “let the banks off the hook.”

But what a time for an attack of conscience, a principled stand for supposed accounting purity! We’ll spend trillions and totally alter the nation’s financial landscape, but a minor (though powerful and free!) accounting change — relaxing mark-to-market — is a bridge too far? Explain that one. (more…)

From the land of good government

Dateline, Illinois. Tim Carney exposes history’s largest earmark.

Quote of the Day

“All you need to do is grant visas to two million Indians, Chinese and Koreans. We will buy up all the subprime homes. We will work 18 hours a day to pay for them. We will immediately improve your savings rate — no Indian bank today has more than 2 percent nonperforming loans because not paying your mortgage is considered shameful here. And we will start new companies to create our own jobs and jobs for more Americans.”

— Shekhar Gupta, editor of The Indian Express newspaper, speaking to Tom Friedman

Quote of the Day

“This is the killer quote from Geithner’s speech: ‘We are exploring a range of different structures for this program, and will seek input from market participants and the public as we design it.’ In other words, we have a plan to have a plan. Ouch.”

— James Pethokoukis, February 10, 2009

Revolution needed

Anatole Kaletsky says we don’t need to fix the existing economic models. We need to start over — a complete reboot.

Wolf vs. Wesbury

The FT’s Martin Wolf is beyond pessimistic on the economy. “Worse than Japan,” he thinks. But probably not as bad as the 1930s. Wonderful. He does, however, think the U.S. and other government spending binges will at least help.

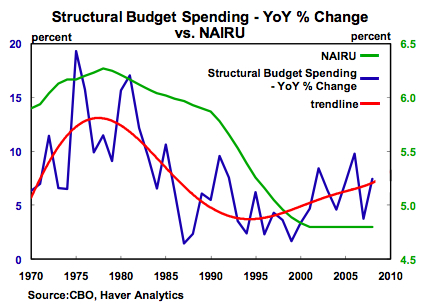

But Brian Wesbury unveils a new chart showing how government spending and unemployment are correlated, beyond the normal cyclical boosts in recessionary government spending. This reinforces work by Alberto Alesina, Robert Barro, and others.

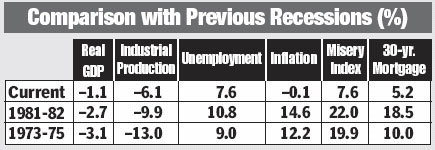

Catastrophe? Or just a recession?

Alan Reynolds pushes back against the idea that we are in a crisis-verging-on-“catastrophe.” Here’s his chart comparing some bad recessions:

The Quantum Future

My friend Louisa Gilder gets a rave from Nature for her new book The Age of Entanglement . . .

Gilder writes a delightfully unconventional history in the form of conversations — real or reconstructed — among the physicists themselves. She emphasizes the recent history of Bell’s theorem, which concerns correlations between the quantum properties of separated elementary particles, its experimental tests and the subsequent exploitation of quantum entanglement in quantum computing, quantum information theory and quantum teleportation.

Gilder’s is, on balance, the better book [Don Howard reviews another physics book, too], partly because of the conversational format, which brings the scientist actors to life as complex personalities with interesting lives. Especially enjoyable are the portraits of the less famous physicists who, starting in the 1960s, put entanglement to the test and taught us how to engineer with it, starting with John Bell and including Abner Shimony, John Clauser, Alain Aspect and Anton Zeilinger.

. . . and she speaks at length with George Johnson about her book and the very latest quantum developments, including a very cool phenomenon called “entanglement swapping.”

“Paulson to China: I don’t blame you. Really.”

The WSJ’s RealTimeEconomics blog reports on Hank Paulson’s clarification to the Chinese over his recent serial blaming of “global imbalances” as the cause of the financial crash.

“In assessing the financial market crisis, I have repeatedly and consistently targeted the vast majority of my criticism at problems in the United States, particularly our flawed and outdated regulatory structure,” Xinhua quoted Mr. Paulson as saying. “Whenever I have commented on global imbalances, it has been against that backdrop and I have gone out of my way to say that no single country is to blame for the imbalances.”

Quote of the Day

“There is something desperate about the way economists are clinging to their dogeared copies of Keynes’ ‘General Theory.’ Uneasily aware that their discipline almost entirely failed to anticipate the current crisis, they seem to be regressing to macroeconomic childhood, clutching the Keynesian ‘multiplier effect’ — which holds that a dollar spent by the government begets more than a dollar’s worth of additional economic output — like an old teddy bear.”

— Niall Ferguson, February 6, 2009

Don’t blame capitalism

It’s the only thing that can save us, write the always excellent Carl Schramm and Bob Litan.

we believe one of the major reasons for the resurgence in productivity growth in the 1990s and through much of this decade was the transformation of our economy from managerial capitalism dominated by large existing firms (think Big Autos, Big Steel, the old AT&T, and the old IBM) into a vibrant form of entrepreneurial capitalism powered by new high-growth firms (think the younger Microsoft, Intel, Cisco, and Google). If too many of our larger financial and nonfinancial firms become wards of the government for too long, we fear that could politicize credit decisions and tilt the economic playing field away from entrepreneurial endeavors. Large enterprises whose creditors know they will be protected if the firms run into trouble are more likely to take imprudent risks and put U.S. taxpayers in jeopardy—as we have learned too well with Fannie and Freddie.