Check out Stephen Wolfram’s new project called Alpha, which moves beyond searching for information on the Web and toward the integration of knowledge into more useful, higher level patterns. I find the prospect of offloading onto Stephen Wolfram lots of data mining and other drudgery immediately appealing for my own research and analysis work. Quicker research would yield more — and one might hope, better — analysis. One can imagine lots of hiccups in getting to a real product, but this video demo offers a fun and enticing beginning.

Climbing the knowledge automation ladder

Bandwidth caps: One hundred and one distractions

When Cablevision of New York announced this week it would begin offering broadband Internet service of 101 megabits per second for $99 per month, lots of people took notice. Which was the point.

Maybe the 101-megabit product is a good experiment. Maybe it will be successful. Maybe not. One hundred megabits per second is a lot, given today’s applications (and especially given cable’s broadcast tree-and-branch shared network topology). A hundred megabits, for example, could accommodate more than five fully uncompressed high-definition TV channels, or 10+ compressed HD streams. It’s difficult to imagine too many households finding a way today to consume that much bandwidth. Tomorrow is another question. The bottom line is that in addition to making a statement, Cablevision is probably mostly targeting the small business market with this product.

Far more perplexing than Cablevision’s strategy, however, was the reaction from groups like the reflexively critical Free Press:

We are encouraged by Cablevision’s plan to set a new high-speed bar of service for the cable industry. . . . this is a long overdue step in the right direction.

Free Press usually blasts any decision whatever by any network or media company. But by praising the 101-megabit experiment, Free Press is acknowledging the perfect legitimacy of charging variable prices for variable products. Pay more, get more. Pay less, get more affordably the type of service that will meet your needs the vast majority of the time. (more…)

The Holiday Inn Express Economy

Rich Karlgaard prescribes disruption — and a good night sleep, sans the truffle — to get us moving again:

Residence Inns, Hyatt Places and Holiday Inn Expresses are perfect examples of disruptive technology. They are newer, cleaner and easier to use. They have a simple mission and they fulfill it. They are well-priced and hit the market bulls-eye. Do you really want to pay an extra $200 per day for turn-down service and a chocolate truffle on the pillow … romantic getaways excepted? Whenever I hire a Residence Inn, Hyatt Place or Holiday Inn Express to do a job, I am pleased.

These new mid-market motels are the Charles Schwabs of the hotel world.

Now let us consider a few American industries that are broken or in need of a refresh: health care, banking, automobiles, energy, to name four.

Quote of the Day

Charlie Rose: “Do we need to change capitalism?”

Bill Gates: “Not in some dramatic way. . . . There are some particular things that went on. But the fundamentals of, you create a company, you have a good idea, you get to hire people. . . . When you do that, the kind of thing that allowed Microsoft, or other great technology companies, to come along . . . I don’t think we’re going to do anything that would really blunt those kind of opportunities, and the huge societal benefits that it creates.”

— Bill Gates interviewed on Charlie Rose, April 28, 2009, at 49:20

Net traffic update…

See two recent articles (here and here) addressing a topic I’ve done lots of research on: Internet traffic growth, mostly due to Web video, and the technology investment needed to both drive and accommodate it.

Here’s one of my papers:

Estimating the Exaflood – 01.28.08 – by Bret Swanson & George Gilder

Party like it’s 1999

My Tech Liberation Front colleague Adam Thierer notes a fun article by Harry McCracken that follows the top 15 Web entities from 1999, asking where they are today. Only six of the top 15 from 1999 remain so in 2009, with nine dropping off, and nine new names you may have heard of.

Bandwidth and QoS: Much ado about something

The supposed top finding of a new report commissioned by the British telecom regulator Ofcom is that we won’t need any QoS (quality of service) or traffic management to accommodate next generation video services, which are driving Internet traffic at consistently high annual growth rates of between 50% and 60%. TelecomTV One headlined, “Much ado about nothing: Internet CAN take video strain says UK study.”

But the content of the Analysys Mason (AM) study, entitled “Delivering High Quality Video Services Online,” does not support either (1) the media headline — “Much ado about nothing,” which implies next generation services and brisk traffic growth don’t require much in the way of new technology or new investment to accommodate them — or (2) its own “finding” that QoS and traffic management aren’t needed to deliver these next generation content and services.

For example, AM acknowledges in one of its five key findings in the Executive Summary:

innovative business models might be limited by regulation: if the ability to develop and deploy novel approaches was limited by new regulation, this might limit the potential for growth in online video services.

In fact, the very first key finding says:

A delay in the migration to 21CN-based bitstream products may have a negative impact on service providers that use current bitstream products, as growth in consumption of video services could be held back due to the prohibitive costs of backhaul capacity to support them on the legacy core network. We believe that the timely migration to 21CN will be important in enabling significant take-up of online video services at prices that are reasonable for consumers.

So very large investments in new technologies and platforms are needed, and new regulations that discourage this investment could delay crucial innovations on the edge. Sounds like much ado about something, something very big. (more…)

The world’s greatest energy analyst…

…with yet another incomparable, iconoclastic article. Peter Huber gives us the facts of life on carbon, oil, coal, nuclear, wind, and solar, with a grasp of economics no other energy commentator can match.

Shoveling wind and sun is much, much harder. Windmills are now 50-story skyscrapers. Yet one windmill generates a piddling 2 to 3 megawatts. A jumbo jet needs 100 megawatts to get off the ground; Google is building 100-megawatt server farms. Meeting New York City’s total energy demand would require 13,000 of those skyscrapers spinning at top speed, which would require scattering about 50,000 of them across the state, to make sure that you always hit enough windy spots.

But even though the world will continue to use massive amounts of carbon, we also will be able to mitigate its effects or sequester it far more rapidly than most believe.

If we’re truly worried about carbon, we must instead approach it as if the emissions originated in an annual eruption of Mount Krakatoa. Don’t try to persuade the volcano to sign a treaty promising to stop. Focus instead on what might be done to protect and promote the planet’s carbon sinks—the systems that suck carbon back out of the air and bury it. Green plants currently pump 15 to 20 times as much carbon out of the atmosphere as humanity releases into it—that’s the pump that put all that carbon underground in the first place, millions of years ago. At present, almost all of that plant-captured carbon is released back into the atmosphere within a year or so by animal consumers. North America, however, is currently sinking almost two-thirds of its carbon emissions back into prairies and forests that were originally leveled in the 1800s but are now recovering. For the next 50 years or so, we should focus on promoting better land use and reforestation worldwide. Beyond that, weather and the oceans naturally sink about one-fifth of total fossil-fuel emissions. We should also investigate large-scale options for accelerating the process of ocean sequestration.

Carbon zealots despise carbon-sinking schemes because, they insist, nobody can be sure that the sunk carbon will stay sunk. Yet everything they propose hinges on the assumption that carbon already sunk by nature in what are now hugely valuable deposits of oil and coal can be kept sunk by treaty and imaginary cheaper-than-carbon alternatives. This, yet again, gets things backward. We certainly know how to improve agriculture to protect soil, and how to grow new trees, and how to maintain existing forests, and we can almost certainly learn how to mummify carbon and bury it back in the earth or the depths of the oceans, in ways that neither man nor nature will disturb. It’s keeping nature’s black gold sequestered from humanity that’s impossible.

Understanding leverage, volatility, and the crash

One can critique Nobel laureate Robert C. Merton’s work on a number of fronts, from the CAPM model to his involvement with the 1998 failure of Long Term Capital Management. And he still doesn’t get to the true source of the current crisis — monetary policy and an erratic U.S. dollar. But I found this MIT lecture useful in explaining how changes in asset prices can drive both instability and volatility in a highly non-linear, pro-cyclical way and confound all the risk and economic models. Merton also offers a simple method to swap risk and improve returns using right-way contracts. (Hat tip: Gordon Crovitz.)

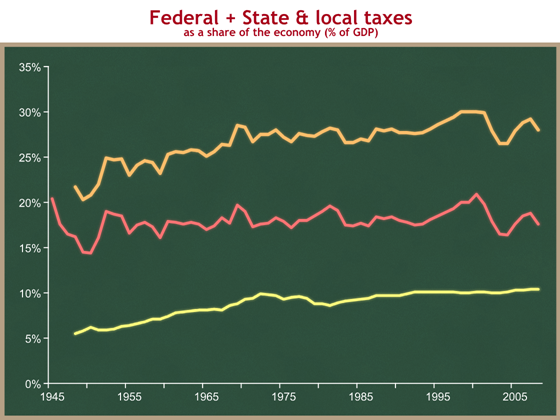

Tax facts … and forecasts

Keith Hennessey with two posts containing lots of good charts on tax trends over the decades and where we are likely headed.

Quote of the Day

“Even when you make [a tax form] out on the level, you don’t know when it’s through if you are a crook or a martyr.”

— Will Rogers, as relayed by Tom Herman, the excellent long-time tax writer for The Wall Street Journal, in his last column today, April 15, 2009

Web 3.0, ctd.

Three media veterans — Gordon Crovitz, Steve Brill, and Leo Hindery — give paid content, via micro-payments and related subscriptions, yet another shot. With iTunes and Amazon also doing their part to advance the model, will we finally get a break-through?

Banking history . . . and future

The events of the last 18 months came so fast and furious, it’s often difficult to remember what in any other time would be singular historic moments, let alone the chronology of the financial meltdown. So Don Luskin does a great service reminding us about just one of many dramas from 2008 — the Wells Fargo acquisition of Wachovia. This week Wells reported a $3 billion profit for the first quarter, shocking the Nationalizers and Depresionistas. How did this happen? Weren’t all the banks supposed to be insolvent? Au contraire:

Last September, Wachovia was the last domino to fall in the horrific sequence of financial firm failures — Fannie Mae, Freddie Mac, Lehman Brothers, Merrill Lynch, AIG, Washington Mutual, and finally Wachovia. The Federal Deposit Insurance Corporation forced its acquisition by Citigroup. The deal was that Citi would pay a measly $1 per share of Wachovia, and the FDIC would invest $12 billion and insure Citi against any losses above certain threshold.

Then Wells came on the scene. It offered to buy Wachovia for $7 a share and told the FDIC that it didn’t need any investment or any guarantees. Believe it or not, Citi had the gall to sue to block Wells’ offer even though in every dimension it was superior for Wachovia stakeholders and for the American taxpayer.

You have to wonder what the FDIC was thinking in the first place. Citi had to take two huge capital injections from the U.S. Treasury under the TARP program in order to survive, and it had to have the Federal Reserve guarantee $300 billion of its toxic assets. So what was the point in having a bank that screwed up take over Wachovia?

Inquiring minds want to know. Maybe Wachovia wasn’t in trouble at all in September. Maybe it was always the diamond in the rough that it now so clearly is in Wells’ hands, and the whole idea was really to prop up Citi with Wachovia, not prop up Wachovia with Citi.

But now, even though Wells was conservative and well-managed during the boom, and could help lead the way out of the crash, it is nonetheless forced to comply with all the silly restrictions imposed by Treasury’s TARP.

no good deed goes unpunished. Back in October when Treasury Secretary Henry Paulson first implemented the new TARP program, he forced every major bank — including Wells — to take TARP money whether they wanted it or not. Wells Chairman Richard Kovacevich told Paulson no, but the Treasury Secretary said it was Wells’ patriotic duty to take the taxpayers’ money like all the rest. So Wells played the good soldier and took the money.

And now it’s sorry it did. Now, because it took government money it didn’t even want, its executives have been made subject to new compensation restrictions enacted by Congress and enforced retroactively. The idea was to make sure that the risk-happy fools who created the financial crisis in the first place now don’t benefit at taxpayer expense — but surely Wells shouldn’t be punished: it was one of the good guys.

Wells’ Kovacevich isn’t shy about complaining. In a speech last month, he said “Is this America — when you do what your government asks you to do and then retroactively you also have additional conditions? If we were not forced to take the TARP money, we would have been able to raise private capital at that time.”

Kovacevich isn’t fond of the Treasury’s latest rescue schemes either, especially the “stress tests” to be applied to the 19 largest banks including Wells. He said, “We do stress tests all the time on all of our portfolios. We share those stress tests with our regulators. It is absolutely asinine…”

This crash is going to look much different upon reflection, isn’t it?

Quote of the Day

“I made a decision a long time ago not to make my career a bet on bad things happening. I think that approach simply corrodes your strategic thought capacity. Human history is progress, so if you’re constantly having to screen out the good to spot the bad, your vision will unduly narrow. If you bet on progress, you can easily contextualize the bad, because progress is never linear. But if you bet on retreat, you must consistently discount advances as ‘illusions’ and ‘buying time’ and so on, and after a while, you’re just this broken clock who’s dead-on twice a day.”

— Thomas P.M. Barnett, April 10, 2009

Apples and Oranges

Saul Hansell has done some good analysis of the broadband market (as I noted here), and I’m generally a big fan of the NYT’s Bits blog. But this item mixes cable TV apples with switched Internet oranges. And beyond that just misses the whole concept of products and prices.

Questioning whether Time Warner will be successful in its attempt to cap bandwidth usage on its broadband cable modem service — effectively raising the bandwidth pricing issue — Hansell writes:

I tried to explore the marginal costs with [Time Warner’s] Mr. Hobbs. When someone decides to spend a day doing nothing but downloading every Jerry Lewis movie from BitTorrent, Time Warner doesn’t have to write a bigger check to anyone. Rather, as best as I can figure it, the costs are all about building the network equipment and buying long-haul bandwidth for peak capacity.

If that is true, the question of what is “fair” is somewhat more abstract than just saying someone who uses more should pay more. After all, people who watch more hours of cable television don’t pay more than those who don’t.

It’s also true that a restaurant patron who finishes his meal doesn’t pay more than someone who leaves half the same menu item on his plate. If he orders two bowls of soup, he gets more soup. He can’t order one bowl of soup and demand each of his five dining partners also be served for free. Pricing decisions depend upon the product and the granularity that is being offered. (more…)

Flameout, meltdown, starburst

Sun Microsystems was the first to know — and to boldly say — that “the network is the computer.” And yet they couldn’t capitalize on this deep and early insight. Here are six reason why.

40 years ago today

Some good history on the evolution of the Internet. I especially liked Steve Crocker’s story about how he and his fellow early Internet developers would share ideas — not by email but by mail. Here’s Crocker’s first “Request for Comments” detailing networking protocols. Today there are some 5,000 RFCs.

Innovations in Tax Cleverness

Among the economic doldrums, we’ve spotted an industry ripe with innovation: Tax accounting! Our ingenious estate tax is forcing increasing numbers of taxpayers to create “intentionally defective grantor trusts.” How, you might ask, can I get one of those? Easy . . .

she will start the trust by giving it some money — $193,670 — to buy the buildings. She won’t owe any gift tax on that transfer, because taxpayers get a lifetime $1 million credit to shield their gifts.

With the $193,670 in seed money, plus a loan for $643,030 from the couple, the trust will buy their stake in the buildings, currently valued at about $1.2 million. The interest rate over the loan’s nine-year term: a mere 2.15%.

In another positive twist, the trust won’t have to pay Drs. Massiah and Emanuele back the full $1.2 million. Because the couple owns the real estate through a limited liability corporation, they can discount the value of the stakes they sell to the trust.

The upshot: The trust only has to pay back $643,030, plus 2.15% interest, says Rudy Fusco, the couple’s estate-planning lawyer at Leeds Morelli & Brown PC in Carle Place, N.Y.

The estate tax doesn’t benefit families, the economy, and not even the government. It raises very little revenue but imposes huge dead weight losses on the economy. It helps only estate lawyers and tax accountants.

Web 3.0

Could the iPhone 3.0 release this summer help create the mechanism — and culture — of micro-payments that many have long been seeking to solve the Web’s intellectual property problem?

UPDATE: These guys were thinking the exact same thing.

Broadband bridges to where?

See my new commentary on the new $7.2 billion broadband program in the Federal stimulus bill. I conclude that if we’re going to spend taxpayer money at all, we should take advantage of local knowledge:

Many states have already pinpointed the areas most in need of broadband infrastructure. Local companies and entrepreneurs are likely to best know where broadband needs to be deployed – and to aggressively deliver it with the most appropriate, cost-effective technology that meets the needs of the particular market. Using the states as smart conduits is also likely to get the money to network builders more quickly.

And that

After falling seriously behind foreign nations in broadband and in our favored measure of “bandwidth-per-capita” in the early 2000s, the U.S. got its act together and is now on the right path. In the last decade, total U.S. broadband lines grew from around 5 million to over 120 million, while residential broadband grew from under 5 million to 75 million. By far the most important broadband policy point is not to discourage or distort the annual $60+ billion that private companies already invest.