Today, Princeton’s Alan Blinder says things are looking up, that we’re finally traveling the road to prosperity, albeit slowly. It’s a rather timid claim:

there are definitely positive signs. The stock market is near a five-year high. Recent data on consumer spending and confidence show improvement, though we need more data before declaring victory. At long last, the housing market is growing rapidly, albeit from a very low base . . . .

On balance, the U.S. economy is healing its wounds—that’s another fact. But none of this puts us on the verge of an exuberant boom. Still, if the fiscal cliff is avoided and the European debt crisis doesn’t explode in our face, both GDP growth and job growth should be higher in 2013 than in 2012—even under current policies. But that’s a forecast, not a fact.

Stanford’s John Taylor counters some of Blinder’s claims:

First, he admits that real GDP growth—the most comprehensive measure we have of the state of the economy—is declining; that’s not an improvement.

Second, he admits that, according to the payroll survey, job growth isn’t faster in 2012 than 2011; that’s not an improvement either.

Third, he mentions that the household survey shows employment growth is faster, but that growth must be measured relative to a growing population. If you look at the employment to population ratio, it is the same (58.5%) in the 12 month period starting in October 2009 (the month he chooses as the low point) as in the past 12 months. That’s not an improvement.

Fourth, he shows that the unemployment rate is coming down. But much of that improvement is due to the decline in the labor force participation rate as people drop out of the labor force. According to the CBO, unemployment would be 9 percent if that unusual and distressing decline–certainly not an improvement–had not occurred.

He then goes on to consider forecasts, saying that there are promising signs, such as the housing market. The problem here, however, is that growth is weakening even as housing is less of a drag, because other components of GDP are flagging.

Meanwhile, there is Northwestern’s Bob Gordon, who is making a much stronger, longer term forecast — that the next several decades will be pretty awful. Specifically, that real U.S. economic growth is likely to halve — or worse — from its recent and historical trend of about 2% per-capita per-year.

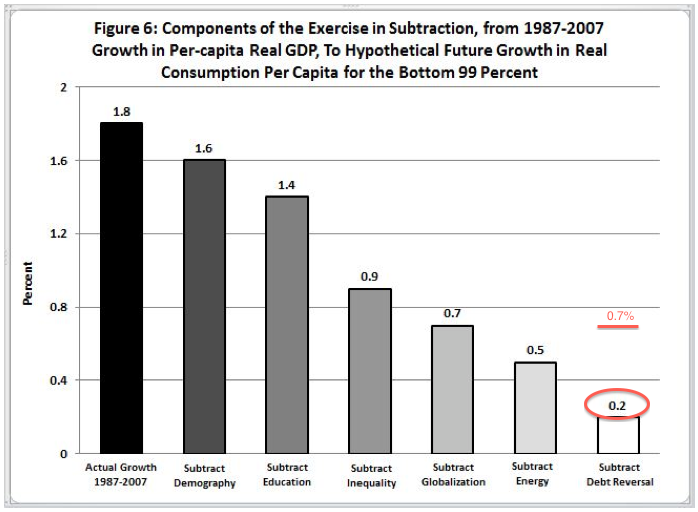

We’ve been emphasizing just how important it is to get the economy moving again, and how important long term growth is for jobs, incomes, overall opportunity, and for governmental budgets. The Gordon scenario is even worse than the so-called New Normal of around 1% per-capita growth (or 2% overall growth). Gordon projects per-capita growth over the next few decades of around 0.7%. (In non-per-capita terms, the way GDP figures are most often reported, that’s about 1.7%). He thinks growth for the “99%” will be far worse — just 0.2% per-capita.

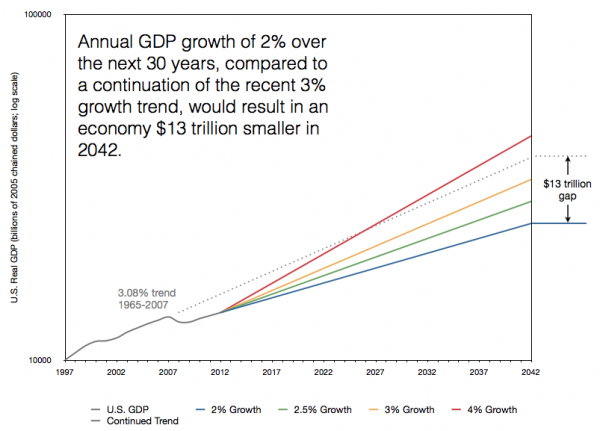

In the chart below, you can see just how devastating a New Normal scenario would be, let alone Gordon’s even more pessimistic projection. It’s urgent that we implement a sweeping new set pro-growth reforms on taxes, regulation, immigration, trade, education, and monetary policy.