Tomorrow, the House Energy and Commerce Committee will hear testimony on one of the spectrum bands most important to the future of 5G wireless. Known as the C-Band, the frequencies are located between 3.7 and 4.2 gigahertz (GHz), which is a kind of sweet spot in the fundamental tradeoff between distance and data rates for all wireless technologies. The spectrum is perfect for the new 5G architecture, which will rely on hundreds of thousands or even millions of small cells, already popping up across the country and around the world.

Right now, however, this band is used by three satellite firms (Intelsat, SES, and Telesat) to broadcast video and radio content to cable TV and radio ground stations for further delivery via terrestrial networks to consumers. Technology is changing this market, however. Increasingly, video and radio content is delivered to distribution points via fiber optic lines, not satellite, and so the satellite firms are left with extra spectrum, and they’d like to sell it. Which works out perfectly. Because the mobile firms would love to buy it for 5G.

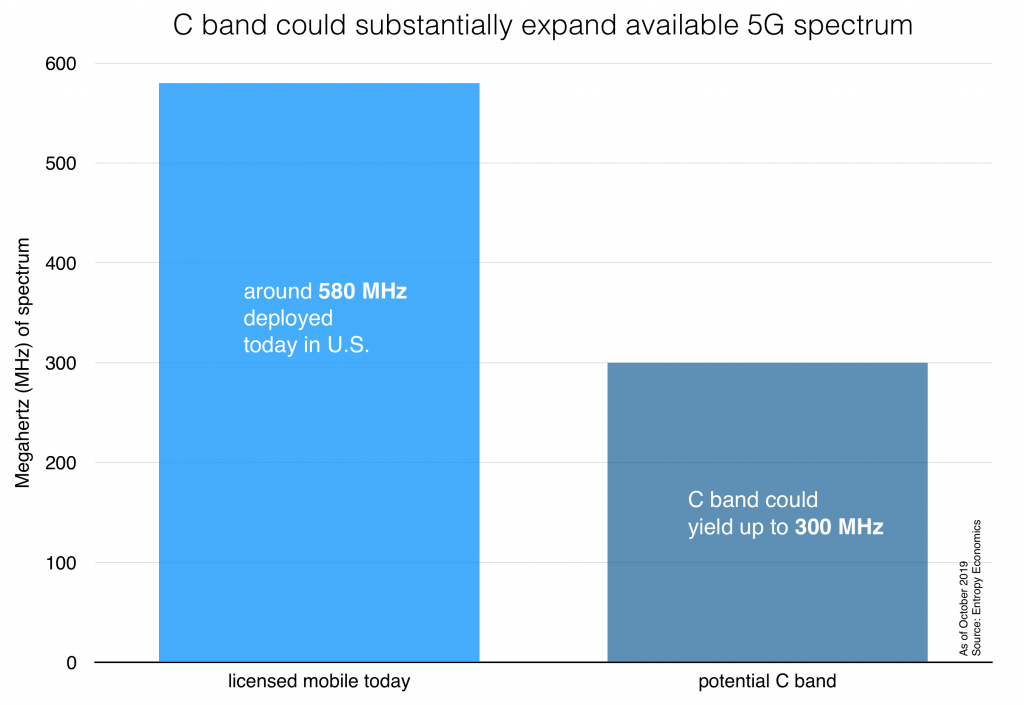

The spectrum is not only perfectly situated for small cell deployments, but there’s also a lot of it. Out of the 500 MHz total held by the satellite firms today, potentially 300 MHz could be auctioned to the mobile firms. To get an idea of how much 300 MHz is, consider that today in the U.S. the mobile firms operate their networks with a deployed spectrum total of only around 580 MHz. So the C band could more than double today’s mobile airwaves.

That’s great news. But moving this spectrum from one set of users and technologies to another can be tricky. A group called the C Band Alliance has proposed a novel mechanism where the satellite firms would, under the supervision of the Federal Communications Commission (FCC), auction a big portion of the 500 MHz directly to the bidding mobile firms. They think the process of auctioning, repacking, and deploying the spectrum, along with necessary ground station and fiber optic upgrades, could be accomplished in two to three years.

Other firms, however, favor a series of incentive auctions run by the FCC. This second group claims the auctions could be done quickly. But that would belie all experience, where auctions this complex would likely take at least several more years, or more than double the time, of the C Band Alliance proposal.

It’s impossible to predict exactly how each proposal would work, and how long it would take. But given the importance of 5G to U.S. economy, at this point I favor speed, which means moving ahead with the C Band Alliance proposal.

For more on 5G, mid-band spectrum, and the economic implications, see some of our other recent items:

Filling the mid-band spectrum gap to sustain 5G momentum