Each year the Federal Communications Commission is required to report on competition in the mobile phone market. Following Congress’s mandate to determine the level of industry competition, the FCC, for many years, labeled the industry “effectively competitive.” Then, starting a few years ago, the FCC declined to make such a determination. Yes, there had been some consolidation, it was acknowledged, yet the industry was healthier than ever — more subscribers, more devices, more services, lots of innovation. The failure to achieve the “effectively competitive” label was thus a point of contention.

This year’s “CMRS” — commercial mobile radio services — report again fails to make a designation, one way or the other. Yet whatever the report lacks in official labels, it more than makes up in impressive data.

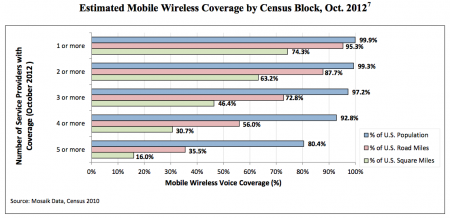

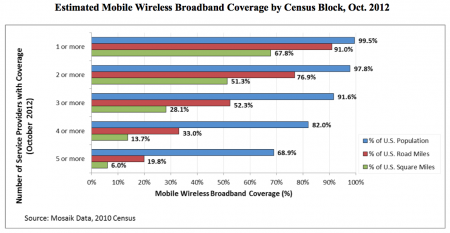

For example, it shows that as of October 2012, 97.2% of Americans have access to three or more mobile providers, and 92.8% have access to four or more. As for mobile broadband data services, 97.8% have access to two or more providers, and 91.6% have access to three or more.

Rural America is also doing well. The FCC finds 87% of rural consumers have access to three or more mobile voice providers, and 69.1% have access to four or more. For mobile broadband, 89.9% have access to two or more providers, while 65.4% enjoy access to three or more.

Call this what you will — to most laypeople, these choices count as robust competition. Yet the FCC has a point when it

refrain[s] from providing any single conclusion because such an assessment would be incomplete and possibly misleading in light of the variations and complexities we observe.

The industry has grown so large, with so many interconnected and dynamic players, it may have outgrown Congress’s request for a specific label.

14. Given the Report’s expansive view of mobile wireless services and its examination of competition across the entire mobile wireless ecosystem, we find that the mobile wireless ecosystem is sufficiently complex and multi-faceted that it would not be meaningful to try to make a single, all-inclusive finding regarding effective competition that adequately encompasses the level of competition in the various interrelated segments, types of services, and vast geographic areas of the mobile wireless industry.

Or as economist George Ford of the Phoenix Center put it,

The statute wants a competitive analysis, but as the Commission correctly points out, competition is not the goal, it [is] the means. Better performance is the goal. When the evidence presented in the Sixteenth Report is viewed in this way, the conclusion to be reached about the mobile industry, at least to me, is obvious: the U.S. mobile wireless industry is performing exceptionally well for consumers, regardless of whether or not it satisfies someone’s arbitrarily-defined standard of “effective competition.”

I’m in good company. Outgoing FCC Chairman Julius Genachowski lists among his proudest achievements that “the U.S. is now the envy of the world in advanced wireless networks, devices, applications, among other areas.”

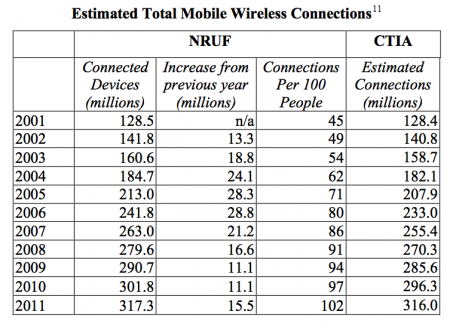

The report shows that in the last decade, U.S. mobile connections have nearly tripled. The U.S. now has more mobile connections than people.

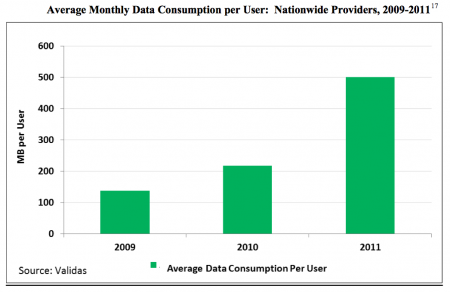

The report also shows per user data consumption more than doubling year to year.

The report also shows per user data consumption more than doubling year to year.

More important, the proliferation of smartphones, which are powerful mobile computers, is the foundation for a new American software industry widely known as the App Economy. We detailed the short but amazing history of the app and its impact on the economy in our report “Soft Power: Zero to 60 Billion in Four Years.” Likewise, these devices and software applications are changing industries that need changing. Last week, experts testified before Congress about mobile health, or mHealth, and we wrote about the coming health care productivity revolution in “The App-ification of Medicine.”

One factor that still threatens to limit mobile growth is the availability of spectrum. The report details past spectrum allocations that have borne fruit, but the pipeline of future spectrum allocations is uncertain. A more robust commitment to spectrum availability and a free-flowing spectrum market would ensure continued investment in networks, content, and services.

What Congress once called the mobile “phone” industry is now a sprawling global ecosystem and a central driver of economic advance. By most measures, the industry is effectively competitive. By any measure, it’s positively healthy.

— Bret Swanson